AUD/USD Price Analysis: Sellers flirt with resistance-turned-support near 0.7150

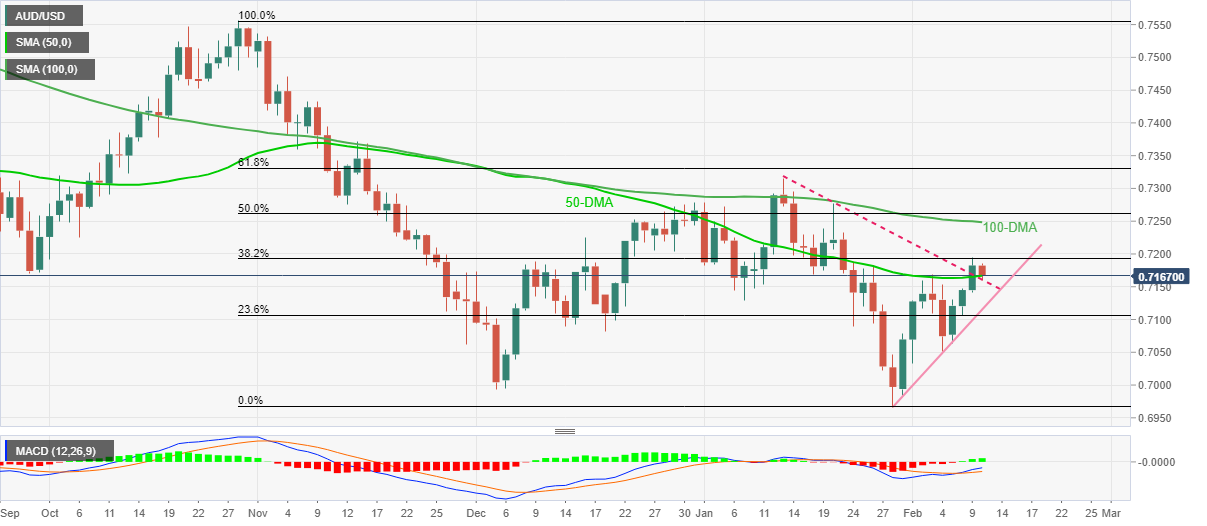

- AUD/USD extends pullback from three-week high towards previous resistance.

- Bullish MACD keeps buyers hopeful to aim for 100-DMA, key Fibonacci retracements can test run-up afterward.

- Confluence of 50-DMA, monthly descending trend line restricts immediate declines.

- Fortnight-long ascending trend line adds to the downside filters.

AUD/USD remains pressured around intraday low, down 0.20% near 0.7170 during the first negative daily performance amid Thursday’s Asian session.

In doing so, the Aussie pair battles a convergence of the 50-DMA and previous resistance line from January 13, around 0.7160.

Given the bullish MACD signals, AUD/USD buyers remain hopeful until witnessing a clear downside break of the 0.7160 key resistance-turned-support level.

Even if the quote drops below 0.7160, a two-week-old rising support line near 0.7115 will challenge the pair bears before giving them control.

Meanwhile, 38.2% Fibonacci retracement (Fibo.) of October 2021 to January 2022 downside, close to 0.7195, joins the 0.7200 threshold to restrict the AUD/USD pair’s short-term advances.

However, the 100-DMA level of 0.7250 and 50% Fibo. around 0.7265 act as important resistances to watch during the quote’s further upside.

AUD/USD: Daily chart

Trend: Further upside expected