Back

8 Dec 2021

USD/CAD Price Analysis: Weekly 38.2% Fibo reached

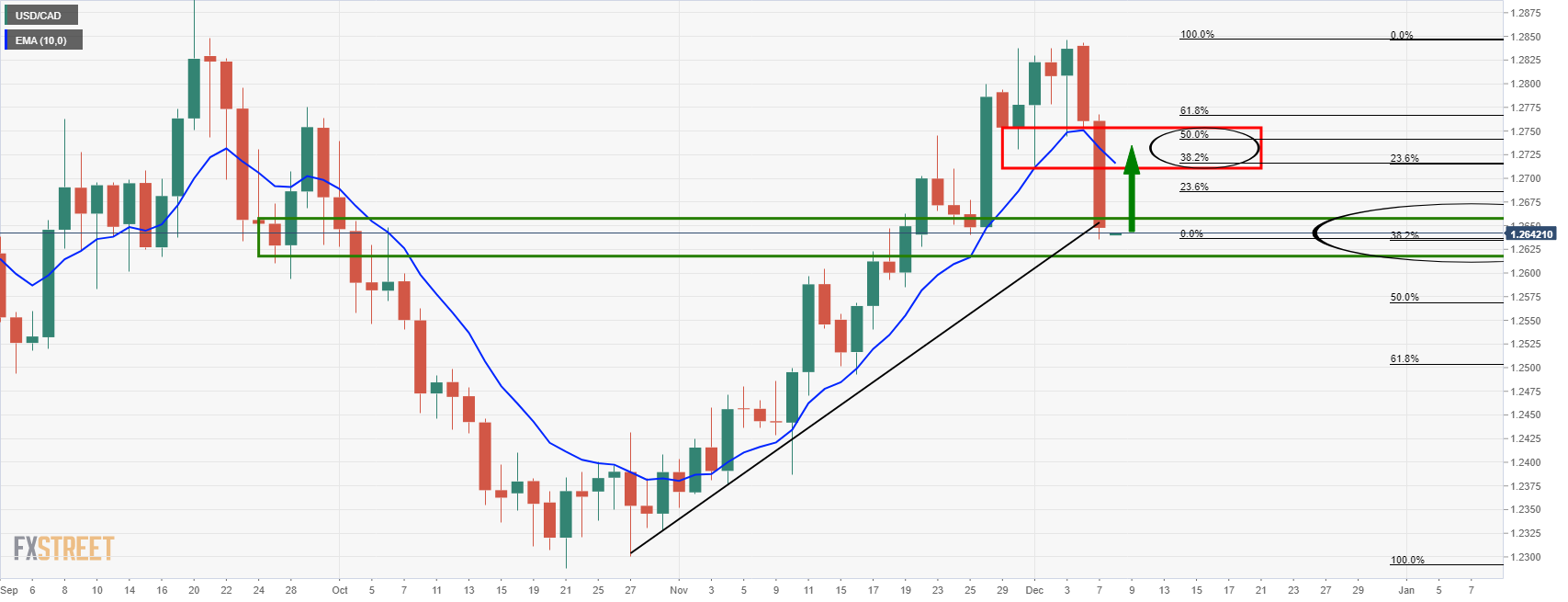

- USD/CAD runs hard into support territory on the weekly and daily time frames.

- Bulls could be looking for an entry should the price start to correct and eye 1.2750.

USD/CAD has dropped this week all the way to the 38.2% Fibonacci retracement of the prior bullish impulse. Moving into the daily time frame, the area has been a significant zone for where transactions took place and it could therefore be expected to act as a support. The following illustrates the price action and confluences of technical influences that could lead to a correction towards 1.2750 in the coming days.

USD/CAD weekly chart

The daily chart illustrates the support more clearly and a correction from here could target a 50% mean reversion near 1.2740 in the coming days:

USD/CAD daily chart

The expected resistance zone also has the 10-EMA in confluence which would be expected to reinforce that area on initial tests.