Gold Futures: Extra rangebound likely

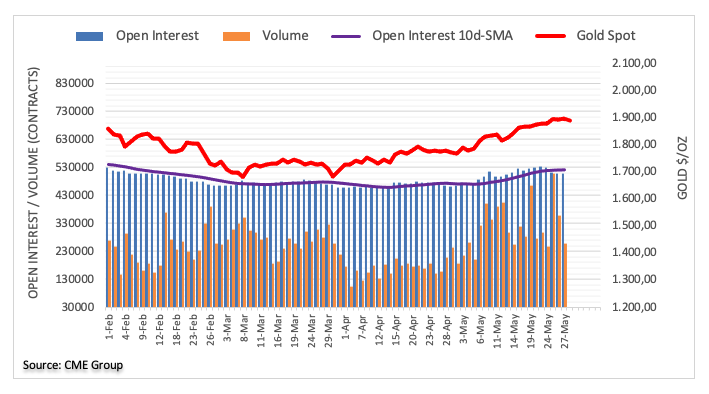

Considering preliminary readings from CME Group for Gold futures markets, open interest reversed three daily pullbacks in a row and went up by nearly 1.5K contracts on Thursday. Volume, instead, shrunk for the second consecutive session, now by around 102.8K contracts.

Gold faces some consolidation near $1,900

Prices of gold charted an inconclusive session on Thursday following the correction lower from peaks above the $1,900 mark (Wednesday). The move was amidst rising open interest, which leaves the door open for the continuation of the consolidative/bearish theme in the very near-term at least. In addition, the yellow metal remains in the overbought territory (as per the daily RSI), which reinforces the likeliness of a deeper retracement. On the upside, the precious metal still targets the psychological $2,000 mark per ounce troy.