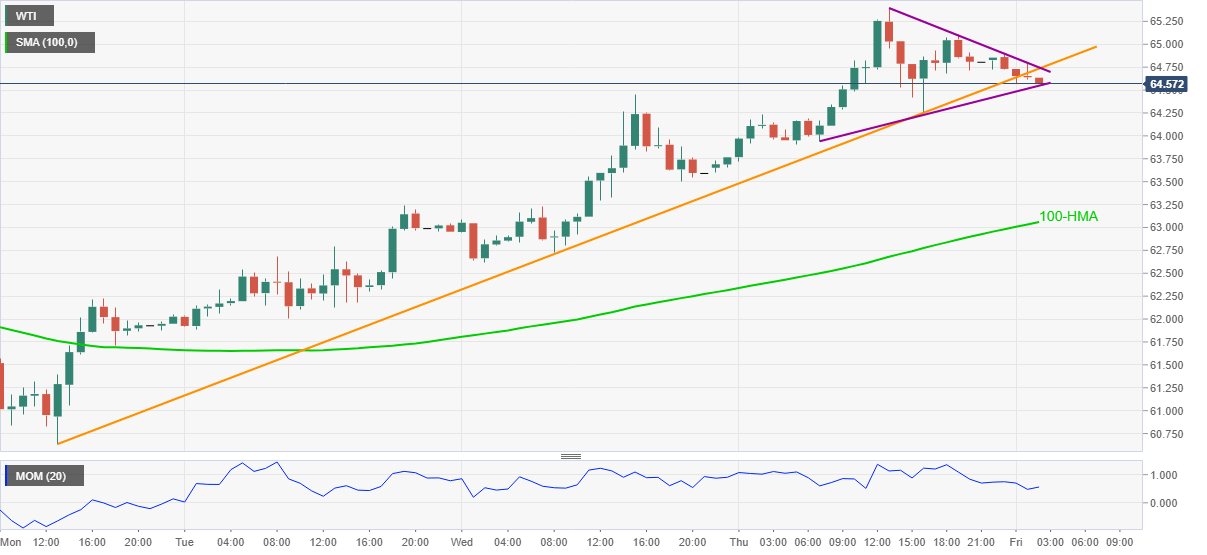

WTI Price Analysis: Immediate pennant, weekly support line test sellers below $65.00

- WTI eases from the highest levels since March 17, flashed the previous day.

- Bearish moves need confirmation, Momentum favors pullback.

- $66.20-30 becomes the key hurdle to watch during fresh upside.

WTI refreshes intraday low to $64.58, down 0.33% on a day, during early Friday. In doing so, the black gold snaps a three-day uptrend while consolidating the previous day’s gains that refreshed the six-week high.

Although the downward sloping Momentum line backs short-term WTI sellers, immediate pennant formation and an ascending trend line from April 22 probes further downside around $64.75-55 area.

In a case where the pullback conquers the immediate support zone, a 200-HMA level near $63.00 will be the key to watch.

Meanwhile, an upside break of the pennant’s resistance line close to $64.80 should cross the latest high, also the highest since mid-March, around $65.40, may test the oil buyers.

If all the WTI bulls keep reins past $65.40, multiple tops marked around $66.20-30 hold the key to further upside towards the yearly peak surrounding $67.85-90.

Overall, WTI is up profit-booking but the bears are less likely to last longer.

WTI hourly chart

Trend: Pullback expected