The Watchlist: NZD/USD and EUR/JPY in focus for the open

- EUR/JPY bears are lurking looking for a break of hourly support to target old daily resistance.

- NZD/USD is ripening for a downside daily extension.

It is going to b a busy week ahead with both the FOMC and Bank of Japan as well as key data such as US Retail Sales on the radar.

Meanwhile, from a technical standpoint, the following illustrates the current pairs under the spotlight for the open and week ahead.

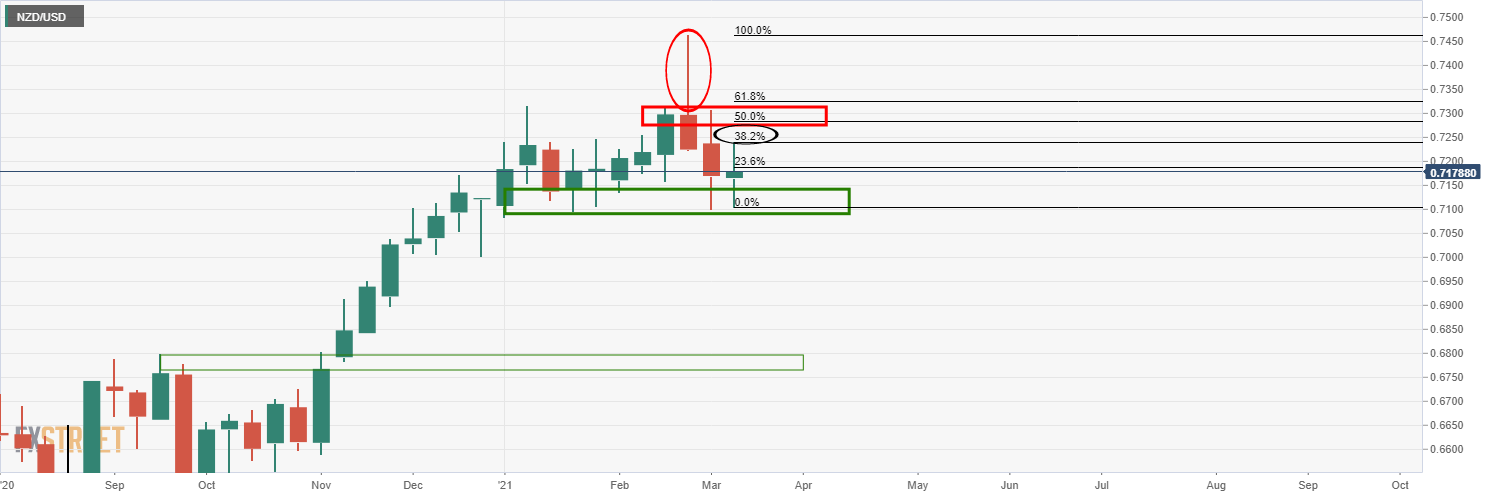

NZD/USD weekly chart

The weekly chart is bearish according to the strong rejection candle.

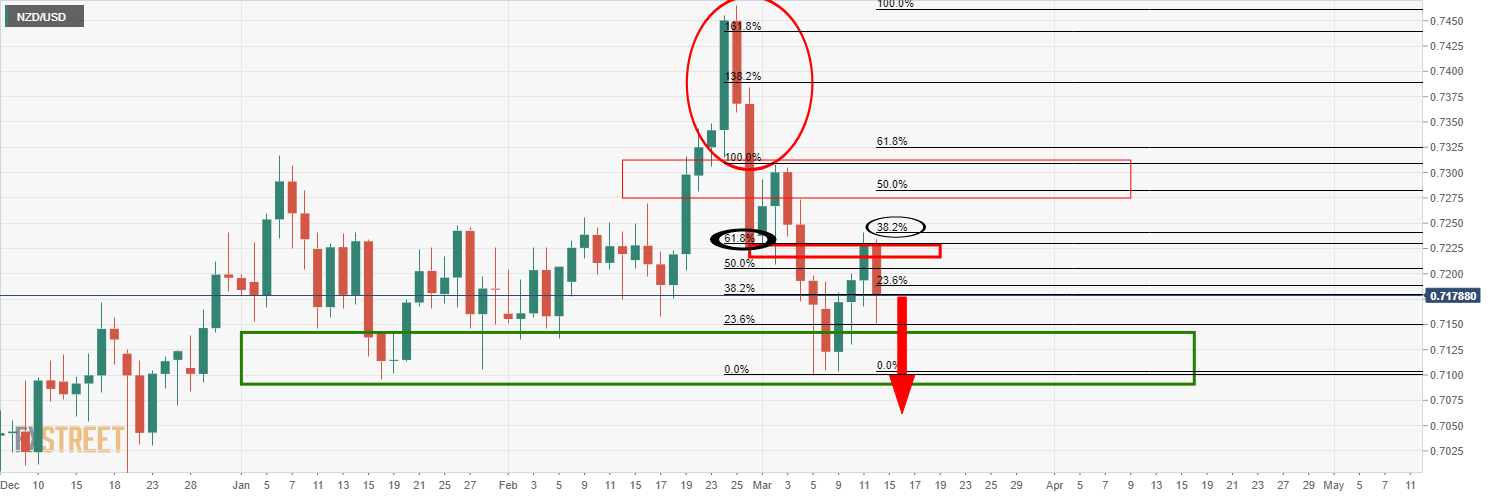

NZD/USD daily chart

The daily bearish engulfing has led to the pair dropping and correcting to a 38.2% Fibonacci retracement level which is significant enough to ow expect a downside continuation to test deeper into the demand zone.

Traders will be on the lookout for bearish conditions on the 4-hour time frame for a swing trading opportunity.

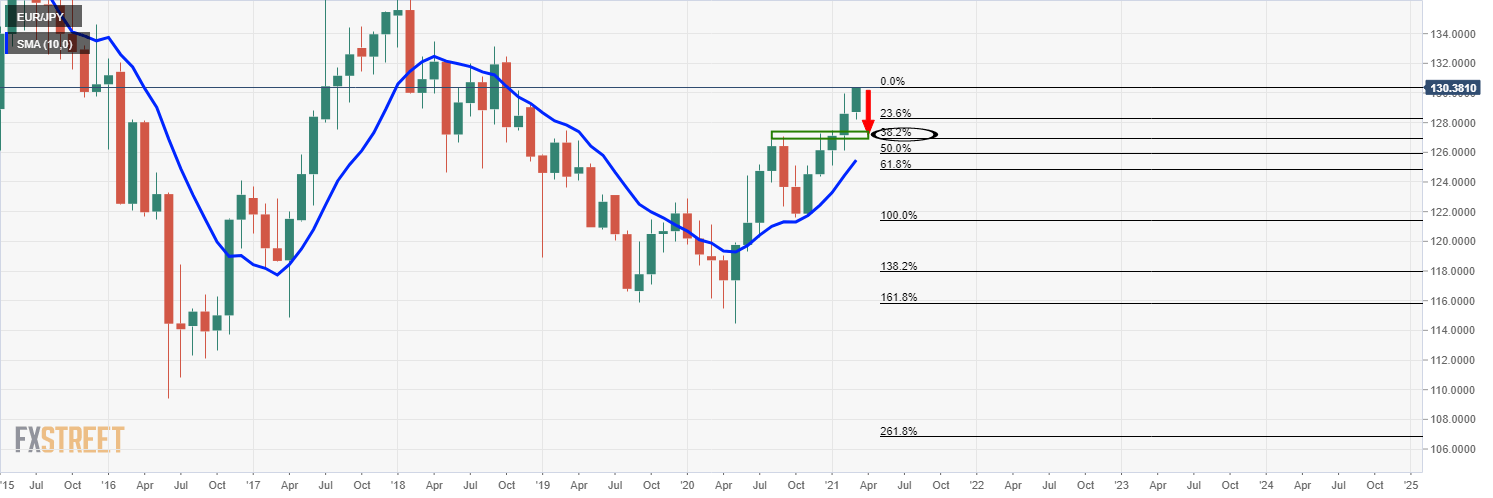

EUR/JPY monthly chart

Meanwhile, the euro cross is meeting resistance and could be due for a correction following a series of consecutive monthly higher closes.

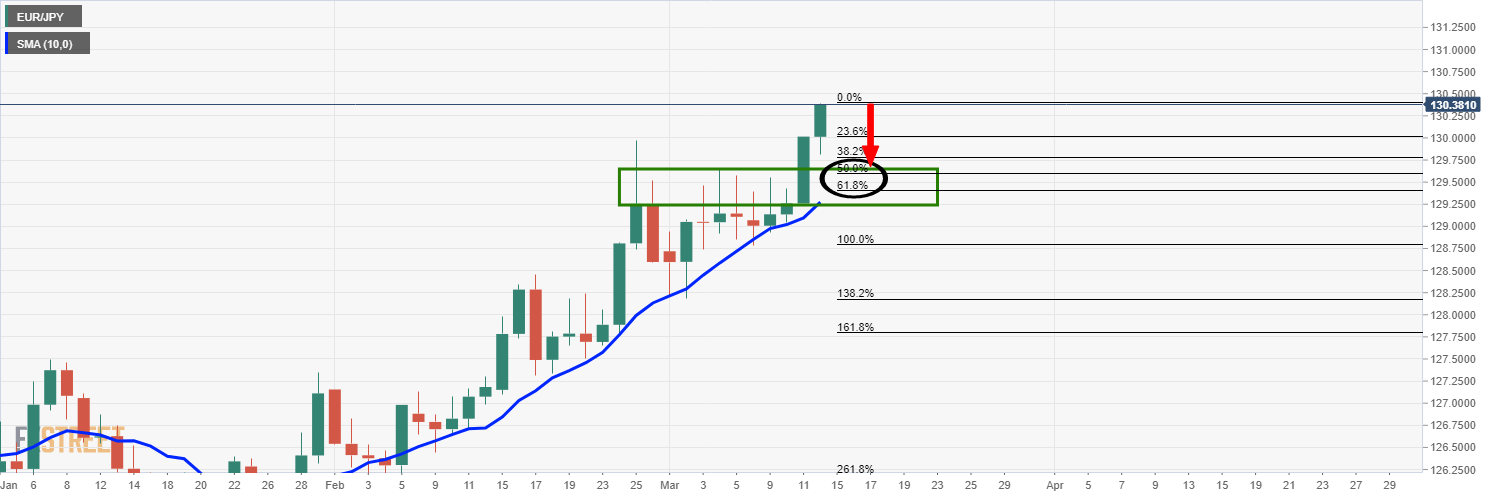

EUR/JPY daily chart

From a daily perspective, the 61.8% Fibo is noted.

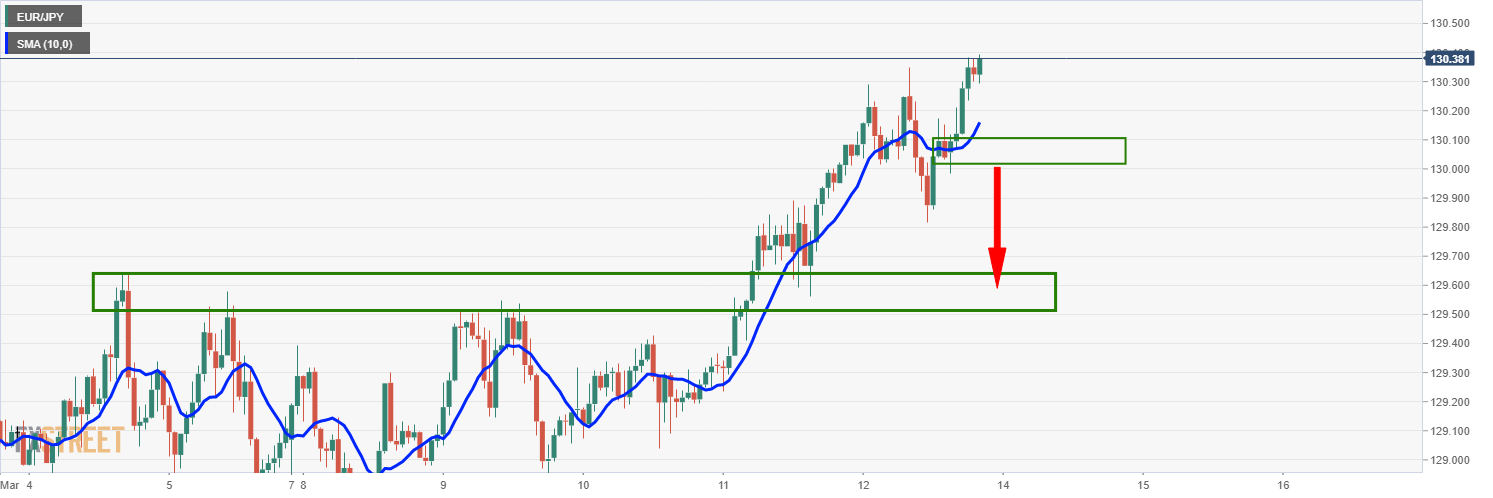

EUR/JPY hourly

However, there is hourly support that the bears will need to conquer first.