S&P 500 Futures Price Analysis: Acceptance above 50-HMA critical to resuming the upside

- S&P 500 futures stuck in a range, awaits a clear direction.

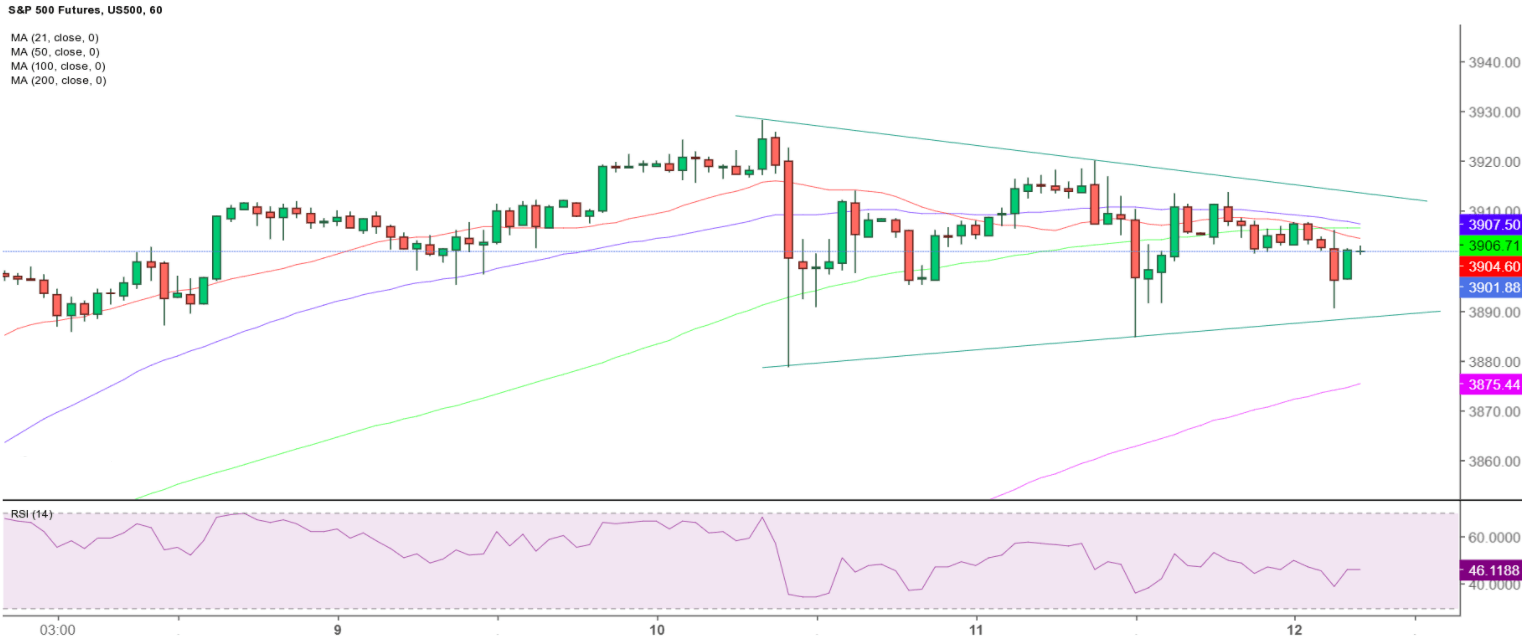

- The price wavers within a pennant formation on the 1H chart.

- The RSI remains bearish, as the bulls await a sustained move above 50-HMA.

S&P 500 futures are seeing ‘buy the dip’ opportunities on every retracement below 3,900, forming higher highs on the hourly chart while keeping the buyers hopeful.

However, the bulls need acceptance above the critical 50-hourly moving average (HMA) at 3,908 to resume the rally towards an all-time-highs. At that level, the 100-HMA also intersects, making it a powerful barrier.

The record highs at 3,928 would be on the buyers’ radars, as 4,000 beckons.

At the time of writing, the sellers seem to have their grip on the futures tied to the S&P 500 index, reflective of the bearish Relative Strength Index (RSI), which points south near 45.85.

The rising trendline support at 3,889 is the level to beat for the bears. Until the support holds, the price will continue to wave within the pennant formation on the said timeframe.

Further south, the bullish 200-HMA at 3,875 could be put at risk in case of a downside break.

S&P 500 Futures: Hourly chart