When is the UK Q4 GDP release and how could it affect GBP/USD?

Friday’s preliminary reading of the fourth-quarter (Q4) UK GDP numbers, up for publishing at 07:00 GMT, gains more importance after the Bank of England’s (BOE) hawkish stint. Market consensus suggests the Office for National Statistics (ONS) print downbeat QoQ figures of 0.5% versus 16% whereas the YoY data may have improved from -8.6% to -8.1%, per the forecasts.

In addition to the quarterly GDP, December’s monthly growth figures will accompany Trade Balance and Industrial Production details for the stated period to keep the GBP/USD traders busy during the early Friday.

Forecasts suggest that the UK GDP will rise to 1.0% MoM in December versus -2.6% prior while the Index of Services (3M/3M) for the same period is seen recovered from +3.7% prior.

Meanwhile, the Manufacturing Production, which makes up around 80% of total industrial production, is expected to ease from 0.7% MoM prior to 0.6% in December. Further, the total Industrial Production is expected to come in at +0.5% MoM as compared to -0.1% marked in November.

Considering the yearly figures, the Industrial Production for December is expected to have recovered to -3.8% versus -4.7% previous while the Manufacturing Production is also anticipated to have declined by 3.3% in the reported month versus 3.8% contraction marked the last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £15 billion versus a £16.01 billion deficit reported in November.

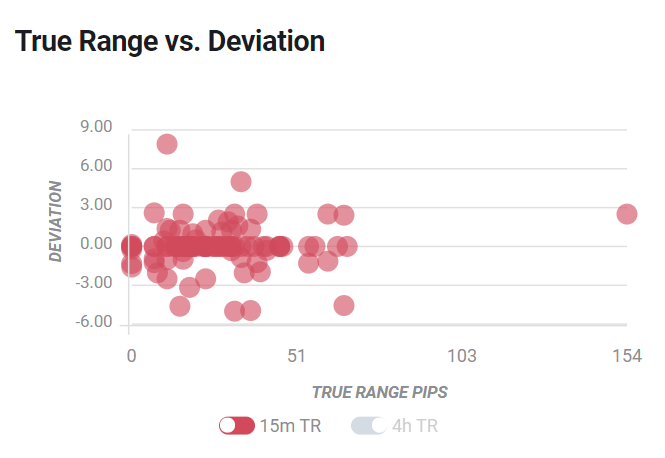

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could it affect GBP/USD?

At the time of press, the pre-London open trading on Friday, GBP/USD stays depressed near the intraday low while flirting with 1.3800, down 0.18% on a day. Although the US dollar’s broad gains could be responsible for the cable’s latest weakness, the EU-UK jitters over the NI border and fears of extended lockdown in Britain also likely to have played their role for please the GBP/USD sellers. In doing so, upbeat comments from BOE’s Chief Economist Andy Haldane seem to have been ignored mostly.

Looking forward, upside surprise by the GDP figures will confirm the BOE’s bullish bias and further push back the negative interest rate chatters, which in turn can recall the GBP/USD bulls catching a breather around the multi-month top. Alternatively, disappointment from the UK GDP will have to gain support from the US dollar’s sustained strength to extend the latest weakness.

In this regard, FXStreet’s Yohay Elam says, “The BOE hinted that the UK economy probably grew at a stronger rate than 0.5% expected – yet that may already be in the price and could trigger a "buy the rumor, sell the fact" response.”

Technically, GBP/USD bears may find it tough to extend the latest pullback moves below January tops near 1.3760 before that buyers can keep the 1.4000 threshold on the radar.

Key notes

UK GDP Preview: Buy the rumor, sell the fact? BOE's bullish stance may backfire

GBP/USD keeps 1.3800 amid cautious optimism over Brexit, virus ahead of UK GDP

GBP/USD Forecast: Pound resilient to the dollar’s demand

GBP/USD Price Analysis: Drops toward previous resistance below 1.3800, UK GDP in focus

About the UK Economic Data

The Gross Domestic Product (GDP), released by the Office for National Statistics (ONS), is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).