When are the UK CPIs and how could they affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for July month is due early on Wednesday at 06:00 GMT. Considering the pair’s recent upward trajectory, in contrast to the dovish BOE, the inflation numbers will be the key for GBP/USD pair.

The headline CPI inflation is expected to remain unchanged at 0.6% on an annual basis. The Core CPI that excludes volatile food and energy items may recede from 1.4% to 1.3% on a YoY basis. Talking about the monthly figures, the CPI could drop to -0.1% from +0.1%.

In this regard, analysts at TD Securities said,

Inflation for July is released, and it won't yet reflect the cut in (Value Added Tax) VAT made in the hospitality sector due to the sampling period (the VAT cut will show up fully in August's data). We look for headline inflation to remain steady at 0.6% y/y (market expectations: 0.6%) and core inflation to slip a notch to 1.3% y/y (forecast: 1.2%). Headline inflation is likely to decline sharply, and into negative territory, in August as the temporary impact of the VAT cut and Eat Out to Help Out scheme both kick in.

Deviation impact on GBP/USD

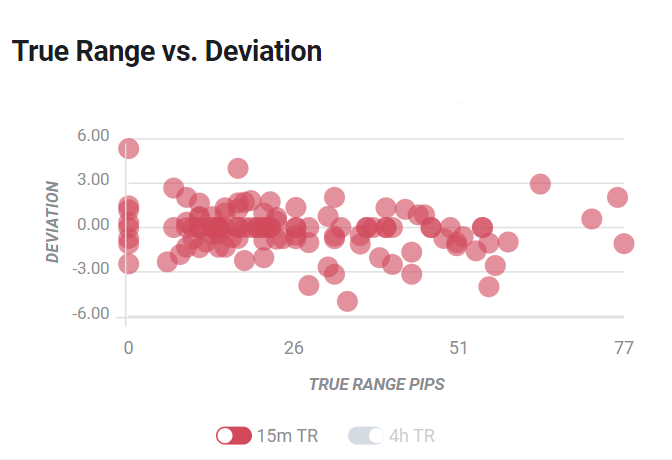

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 120 pips.

How could it affect GBP/USD?

By the press time of pre-London open on Wednesday, GBP/USD eases from the 7.5-month high flashed earlier in Asia. In doing so, the cable slips beneath 1.3250 while missing the yearly high of 1.3266 by two basis points (bps).

The pair has mainly cheered the US dollar weakness as the DXY refreshed the lowest levels since May 2018 the previous day. Even so, fears of another failed attempt to seal the Brexit deal during the seventh round of negotiations highlights the risk of the pair’s declines from the multi-month high. As a result, today’s inflation data becomes the key as the Bank of England (BOE) holds a dovish outlook for the economy despite expecting the sharper economy.

While identifying the catalysts, FXStreet’s Joseph Trevisani says,

Stronger than forecast price data will reduce the risk of the BOE joining the European Central Bank (ECB) and many EU national banks with negative main rates.

Technically, sustained trading beyond 1.3200 favors the bulls but overbought RSI and nearness to the area comprising December 13 low and 31’s peak, around 1.3285-3305, challenge the pair’s further upside.

Key notes

GBP/USD Price Analysis: Bulls attack yearly top beyond 1.3250 ahead of UK CPI

GBP/USD Forecast: Poised to defy the year high at 1.3266

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).