Gold Price Analysis: XAU/USD eyes two key hurdles ahead of $1921.17 – Confluence Detector

Gold (XAU/USD) has stalled its five-day upsurge, entering a phase of consolidation before the next leg higher. The buyers have the life-time at $1921.17 on their radar but a break above the 1900 level is critical for the further upside.

So far this Friday’s Asian trading, the persistent weakness in the US dollar across its main peers, in the wake of the renewed concerns over the US economic recovery, stimulus stand-off and fresh lockdowns in the country, continues to keep the buying interest intact in the yellow metal. The US dollar index meanders near 22-month lows of 94.57, posting small losses, at the press time.

Further, the massive global stimulus and expectations of a prolonged period of low real interest rates make the non-yielding gold more attractive. In the day, the focus now remains on the US dollar dynamics ahead of the US Markit Manufacturing PMI and housing data, especially after the US jobless claims disappointment.

At the press time, gold is marginally lower at $1885, hovering within a $10 range, with the fundamentals and economic data continuing to back the case for additional gains. Let’s see how it is positioned, as outlined by the Technical Confluences Indicator.

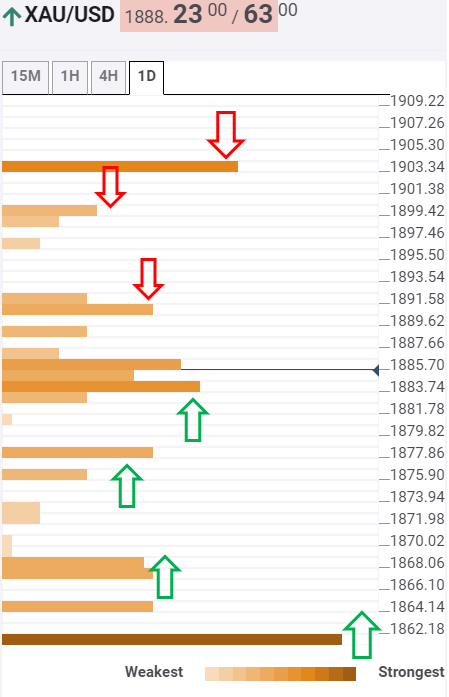

Key resistances and supports

According to the tool, the precious metal needs to pierce through the nine-year highs at $1898.44, where Fibonacci 23.6% one -day lie, to take on the $1900 level.

A decisive break above the $1900 round figure would call for a test of the powerful barrier at $1904, the convergence of the Bollinger Band four-hour Upper and Pivot Point one-day R1.

The record high at $1921.17 will be the next upside target.

To the downside, $1883 is the immediate cushion, where the previous low on the hourly and 15-minutes charts intersect.

The next support is aligned at the Fibonacci 61.8% one-day of $1877, below which the SMA10 four-hour at $1875 could be tested.

Further south, a cluster of support levels is seen around $1867, the confluence of the pivot point one-day S1 and Bollinger Band one-day Upper.

As long as the $1862/61 level holds (pivot point one-month R2), the ongoing bullish momentum will likely remain intact.

Here is how it looks on the tool

About the Confluence Detector

The Confluence Detector helps gauge the path of least resistance. It locates and points out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc.

Learn more about Technical Confluence