Back

13 Jul 2020

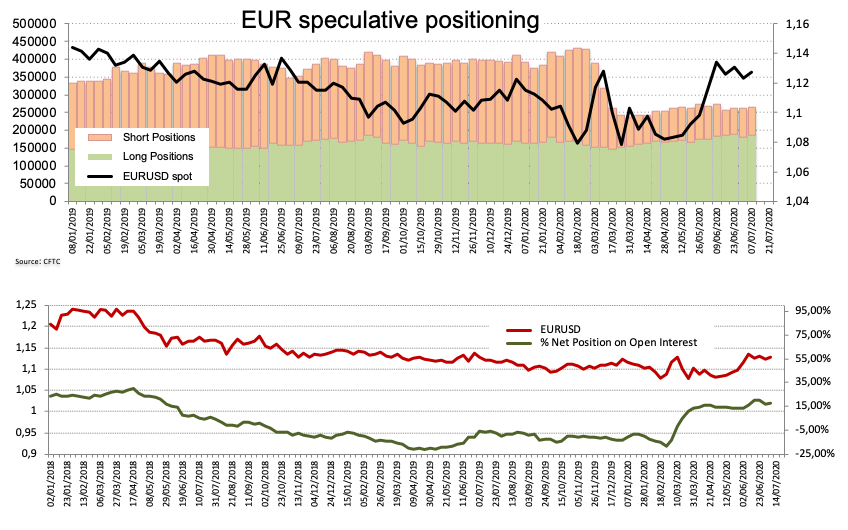

CFTC Positioning Report: EUR net longs climbed to 2-week highs

These are the main highlights of the latest CFTC Positioning Report for the week ending on July 7th:

- Speculators added EUR gross longs and kept steady the gross shorts during the week ended on July 7th, taking net longs to 2-week highs to around 103.6K contracts. EUR extended the uptrend for yet another week always backed on the improved mood in the riskier assets, in turn sustained by solid hopes of a strong economic recovery post-pandemic.

- On the opposite direction, risk appetite trends motivated USD net longs to ease to 2-week lows and stay within the negative territory for the fourth straight week. By the same token, JPY net longs retreated to the lowest level since March 10th and net longs in the Swiss safe haven CHF receded to 2-week lows.

- The apparent solid recovery in the Chinese economy and commodity prices coupled with the positive outlook on the domestic economy and the RBA stance have been lending extra support to the Aussie dollar in past weeks, dragging AUD net shorts to the lowest level since early April 2018.