NZD/USD Price Analysis: Off intraday high, still above 0.6150

- NZD/USD slips from the daily top of 0.6194 after New Zealand’s ANZ Business Confidence and Activity Outlook data.

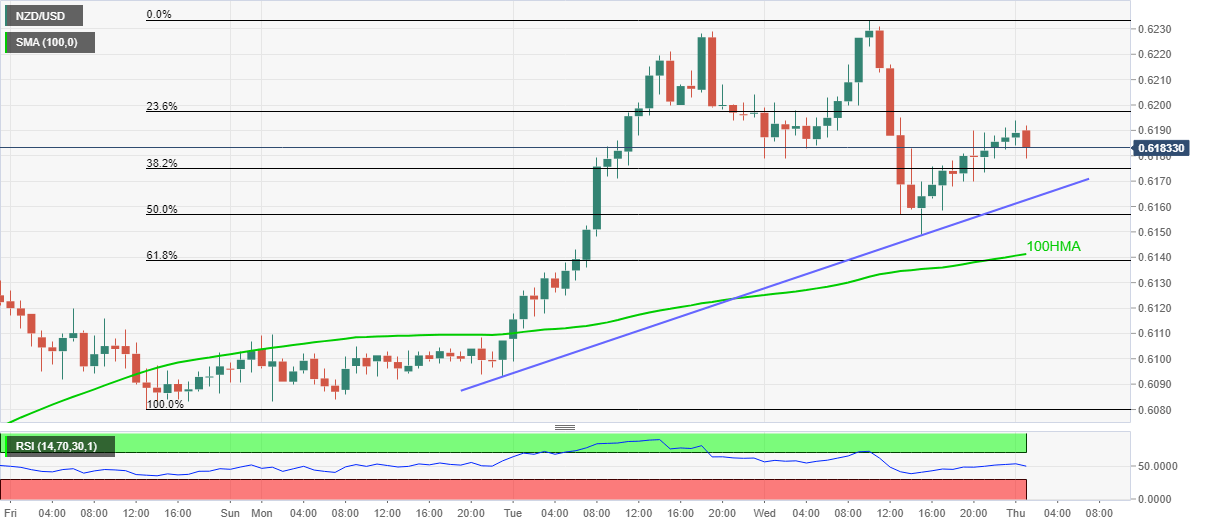

- Weekly support line and Wednesday’s low keep buyers hopeful.

- 200-day EMA on the daily chart becomes strong upside resistance.

NZD/USD drops to 0.6180 after New Zealand’s (NZ) second-tier data flashed during Thursday’s Asian session.

The ANZ Business Confidence came out at better than -86.3 forecast and -45.6 prior to -41.8 whereas ANZ Activity Outlook also recovered from -73.2 expected to -38.7.

Despite stepping back, the Kiwi pair stays above short-term support line, at 0.6165, a break of which can drag the quote to the previous day’s low near 0.6150.

However, a confluence of 100-HMA and 61.8% Fibonacci retracement of May 22-27 upside, around 0.6140, could restrict the Aussie pair’s further downside.

On the upside, buyers may remain cautious ahead of refreshing the monthly top near 0.6235.

Though, a sustained break above 0.6235 enables the NZD/USD optimists to probe a 200-day EMA level near 0.6300.

NZD/USD hourly chart

Trend: Bullish