Back

4 May 2020

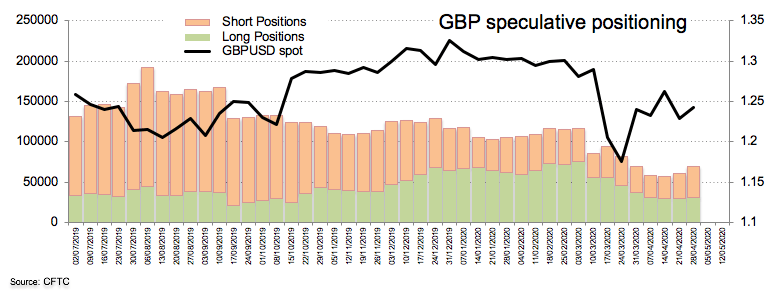

CFTC Positioning Report: Net shorts in GBP climbed to multi-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on April 28th:

- The speculative community added shorts to their already negative stance on the British Pound, taking the net shorts to the highest level since December 10th, 2019. In fact, the potential extension of the lockdown in the UK economy plus uncertainty regarding the potential re-opening of the economy at a later stage continued to undermine the sentiment around the quid during last week. In addition, Brexit fears appear to have returned to the fore along with the likeliness of further easing by the BoE amidst the expected drop of the economic activity.

- EUR net longs lost momentum during last week, receding to fresh 3-week lows amidst increasing cautiousness among market participants ahead of the ECB event. The solid current account position in the euro area along with prospects of the re-opening of many economies in the Old Continent have been also sustaining the recent better mood around the euro.

- USD net longs rose to the highest level since the beginning of March on the back of persistent safe haven demand and rising hopes of a gradual re-opening of the US economy.