Back

29 Apr 2020

US Dollar Index Asia Price Forecast: DXY drifting down post-FOMC, US GDP

- US dollar index (DXY) is on track to end the New York session below the 99.65 resistance.

- The Fed leaves rates unchanged as widely expected.

- The level to beat for bears is the 99.30 support.

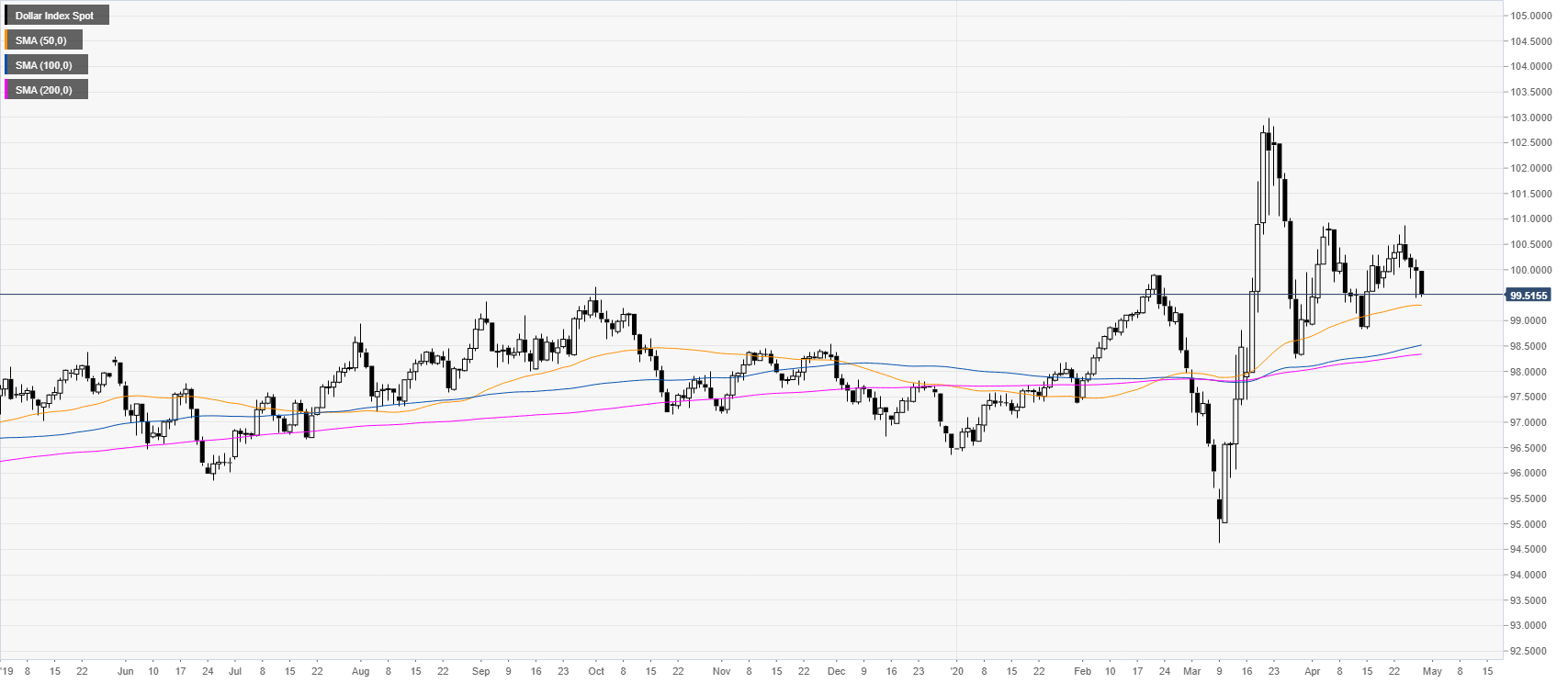

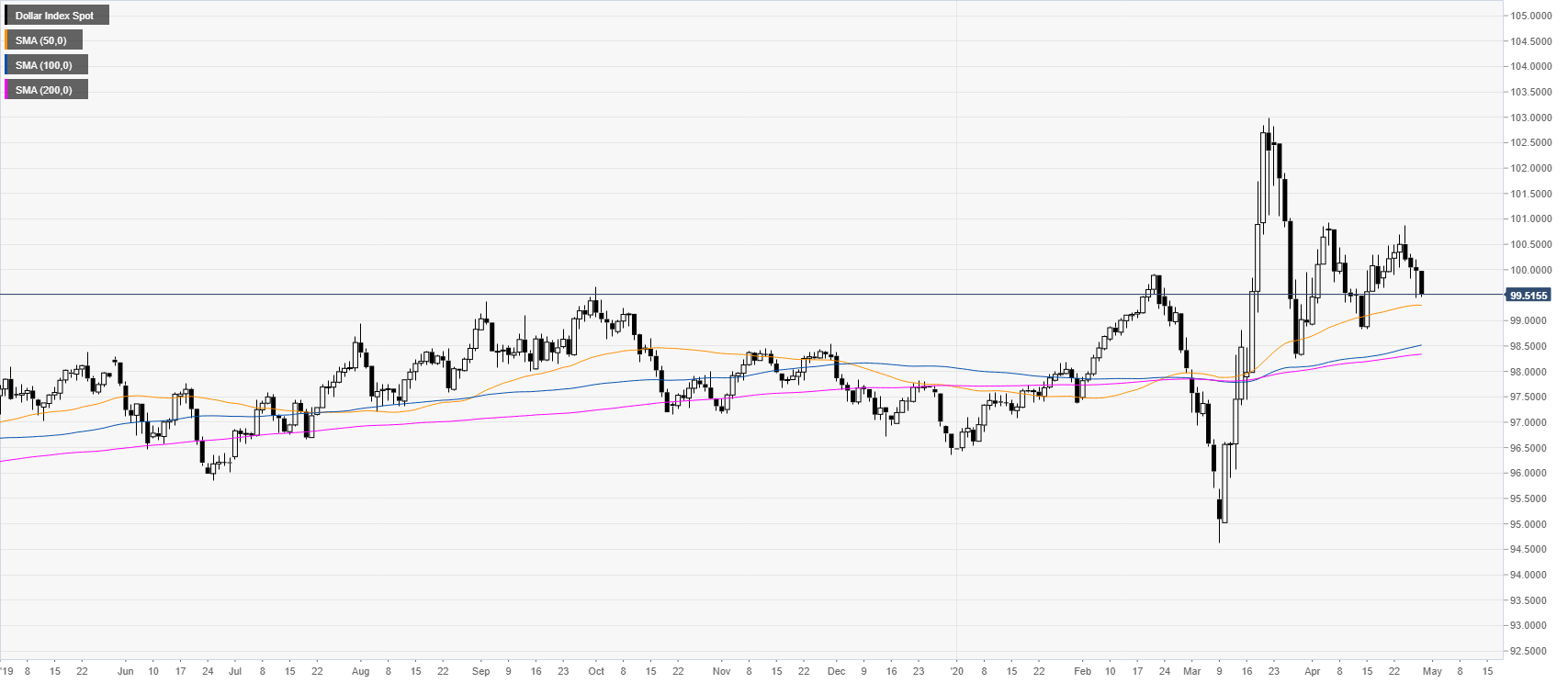

DXY daily chart

DXY is trading above the main daily SMAs suggesting an underlying bullish bias, however, the greenback is drifting down slowly while below the 100.00 mark key psychological level. The Fed left rates unchanged while Fed Chairman, Powell pledged to do whatever it takes to put the US economy back on track. Earlier the US GDP in the first quarter contracted 4.8%, worse-than-anticipated.

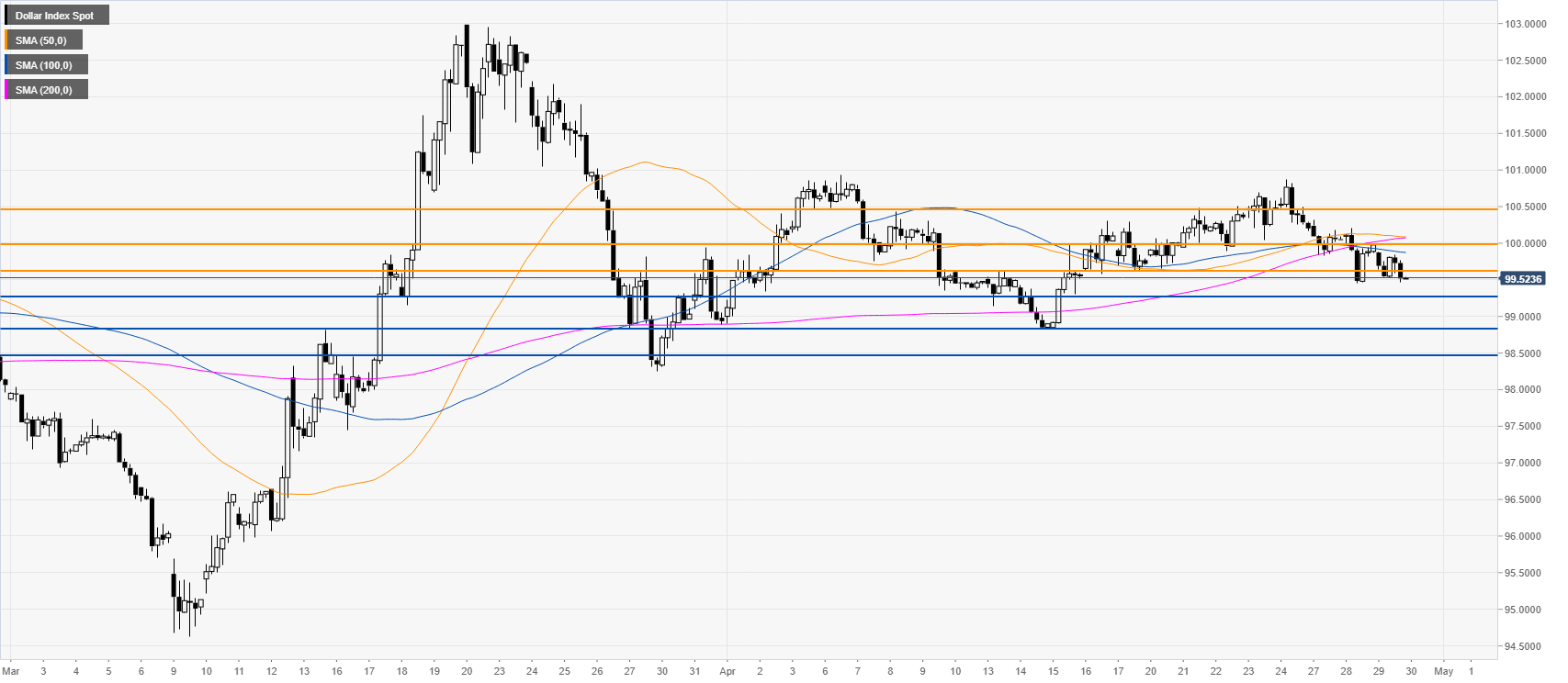

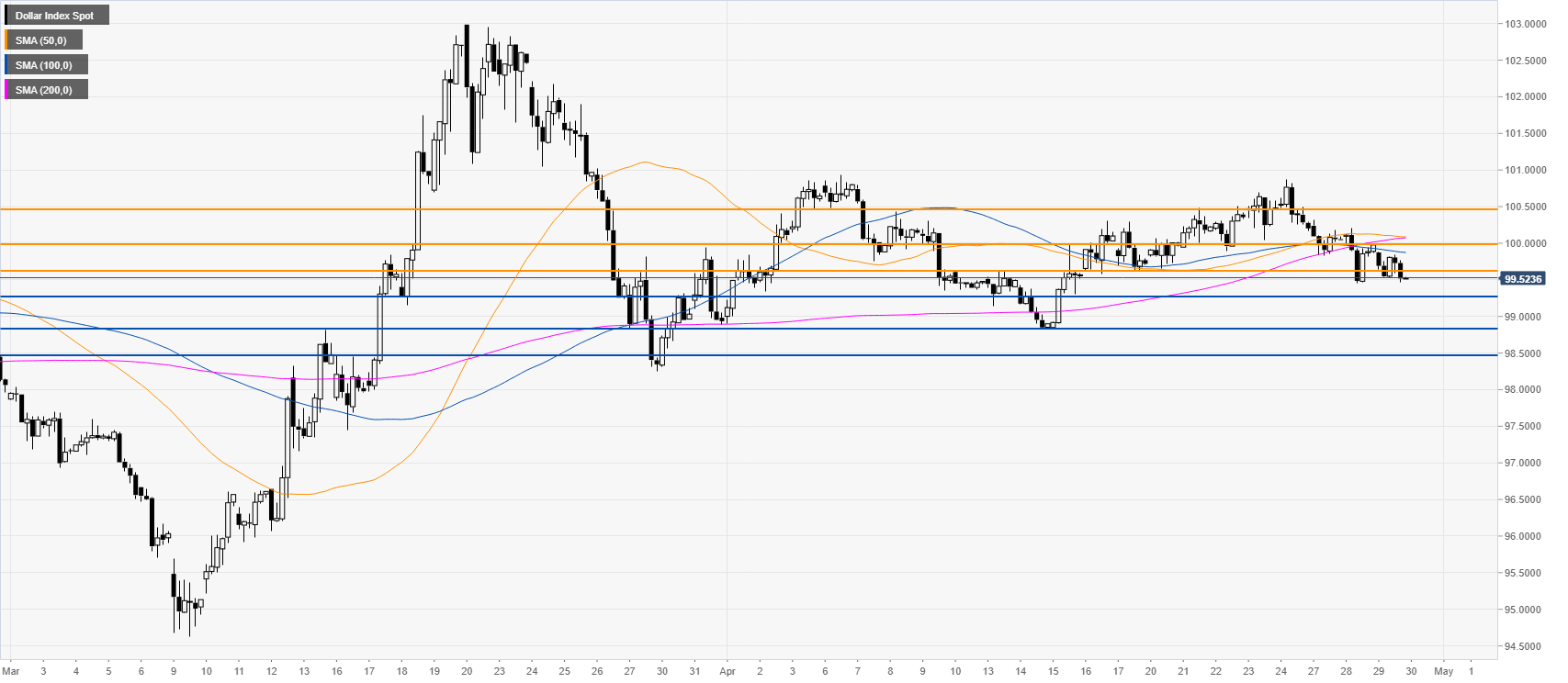

DXY four-hour chart

DXY is under mild bearish pressure while below the main SMAs on the four-hour chart as the market is moving down very slowly. The greenback is trading below the 99.65 resistance level and a daily close below it can open the doors to further downward traction towards the 99.30 and 98.90 levels in the short-term. On the flip side, resistance should emerge near 99.65 and the 100.00 mark.

Additional key levels