Back

3 Apr 2020

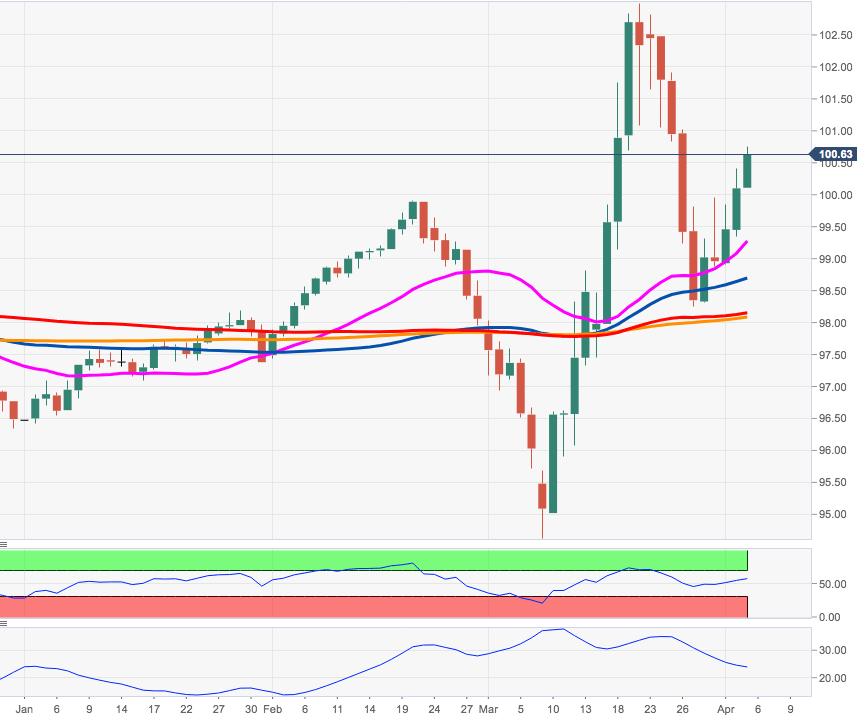

US Dollar Index Price Analysis: A visit to 2020 highs near 103.00 stays on the cards

- DXY has quickly left behind the key barrier at 10.00 the figure.

- The outlook remains positive above the 200-day SMA around 98.00.

DXY is extending the positive momentum beyond the 100.00 mark, quickly taking out the interim hurdle at the Fibo retracement at 100.49.

Bulls keep dominating the markets for the time being and a move to the yearly highs in the 103.00 neighbourhood should not be surprising in the next sessions.

So far, the positive outlook on the dollar remains unchanged as long as the 200-day SMA, today at 98.07, holds the downside.

DXY daily chart