WTI bounces off 17-year lows in sub-$20.00/bbl levels

- WTI extends the drop to sub-$20.00 levels, or 17-year lows.

- Demand shock led by COVID-19 panic weighs on sentiment.

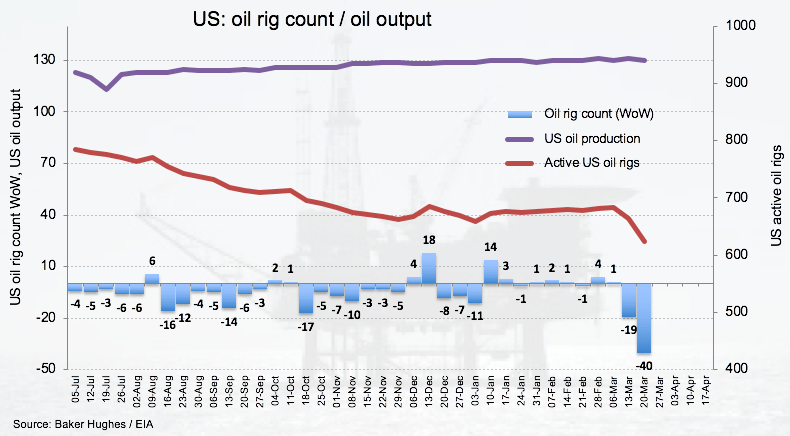

- US oil rig count dropped by 40 during last week.

Prices of the American benchmark for the sweet light crude oil dropped to fresh 17-year lows in the $19.90 region per barrel earlier in the session, just to regain mild traction afterwards.

WTI remains under heavy pressure

The barrel of WTI is receding for the fourth consecutive session at the beginning of the week, resuming the downside after the failed move beyond the $28.00 mark seen in mid-March.

Crude oil prices remain under heavy downside pressure amidst unremitting concerns over the demand for the commodity stemming from the impact of the coronavirus on the global growth, while the Russia-Saudi Arabia price war continues to hurt prices from the supply side. Later on Monday, President Trump is expected to speak with Russia’s V.Putin, with the oil crisis on top of the agenda.

Also reflecting the sour sentiment in the industry, driller Baker Hughes reported US oil rig count went down by 40 during last week, taking the total active oil rigs to 624. As usual, later in the week the API and the EIA will report on US crude oil inventories on Tuesday and Wednesday, respectively.

What to look for around WTI

Crude oil prices remain under unabated pressure in a context dominated by the lethal combination of supply and demand drivers. Also adding extra pressure, there is still the possibility that Saudi Arabia could carry on with its plans to increase oil exports by more than 12M bpd as soon as the next month. A potential relief to this low-lower-prices-scenario could come in the form of a US intervention, which is expected to morph into some sort of agreement between the US, Russia, Saudi Arabia and some other countries.

WTI significant levels

At the moment the barrel of WTI is retreating 7.77% at $20.11 and a breach of $19.95 (2020 low Mar.30) would expose $17.12 (monthly low November 2001) and finally $10.65 (monthly low December 1998). On the upside, the next resistance aligns at $25.20 (weekly high Mar.25) followed by $28.46 (high Mar.20) and then $31.32 (21-day SMA).