When are the UK data releases and how could they affect GBP/USD?

The UK Economic Data Overview

The UK docket has the monthly GDP and the fourth quarter GDP releases today, alongside the releases of the Kingdom’s Trade Balance and Industrial Production, all of which will drop parallelly later on Tuesday at 0930 GMT.

The United Kingdom GDP is expected to arrive at +0.2% MoM in December while the Index of Services (3M/3M) for December is seen lower at 0.0%.

The first readout of the Q4 GDP is seen weaker at 0.0% QoQ and +0.8% YoY.

Meanwhile, the manufacturing production, which makes up around 80% of total industrial production, is expected to rebound 0.5% MoM in December vs. -1.7% recorded in November. The total industrial production is expected to come in at +0.3% MoM in Dec as compared to the previous reading of -1.2%.

On an annualized basis, the industrial production for Dec is expected to have dropped by 0.8% versus -1.6% previous while the manufacturing output is also anticipated to have declined by 1.0% in the reported month versus -2.0% last.

Separately, the UK goods trade balance will be reported at the same time and is expected to show a deficit of £10.00 billion in Dec vs. £5.256 billion deficit reported in Nov.

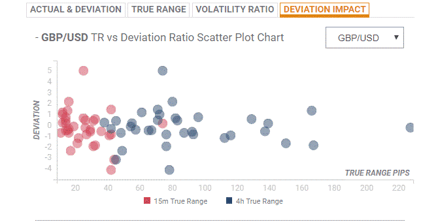

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements in excess of 60-70 pips.

How could affect GBP/USD?

At the press time, the GBP/USD stalls its recovery momentum and turns negative, battling the 1.29 handle, with all eyes on the critical UK macro releases.

According to FXStreet’s Analyst. Haresh Menghani: “Traders are likely to wait for a sustained weakness below 100-day SMA, around the 1.2895 region, before positioning for any further depreciating move. The pair then might accelerate the slide further towards the 1.2830-25 horizontal support en-route the 1.2800 round-figure mark.”

“On the flip side, the 1.2950-60 region now seems to have emerged as an immediate strong resistance, above which the pair is likely to aim towards reclaiming the key 1.30 psychological mark – representing a short-term ascending trend-line support break-point. Any subsequent recovery is likely to confront some fresh supply and remain capped near the 1.3025-25 resistance zone,” Haresh adds.

Key Notes

UK: Q4 GDP and Carney’s speech in focus – TD Securities

UK GDP Preview: Stagnation may be good enough for pound bulls, three GBP/USD scenarios

UK shoppers still wary about spending in January - BRC

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.