Back

2 Jan 2020

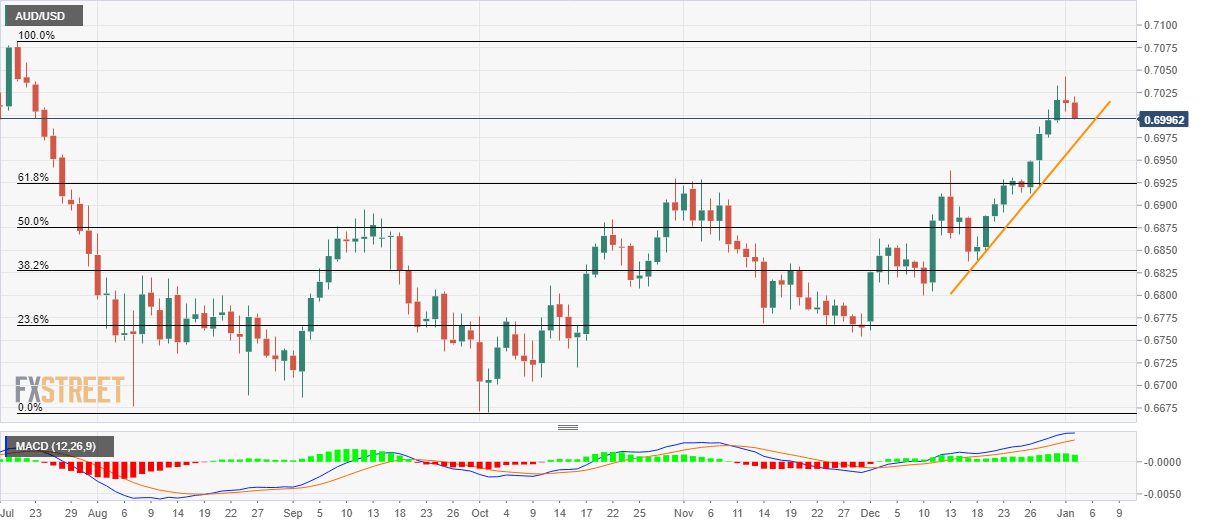

AUD/USD Technical Analysis: Sellers aim for two-week-old ascending trendline

- AUD/USD declines from the five-month top.

- Short-term support line, 61.8% Fibonacci retracement are on sellers’ radar.

- July’s top keeps the upside limited.

AUD/USD falls to 0.7000 ahead of the European session on Thursday. The pair took U-turn from the five-month high, eyes are on the two-week-old support line, at 0.6968, during the further drop.

In a case where prices fail to respect short-term support line, 61.8% Fibonacci retracement of July-October declines, at 0.6925 will be the Bears’ favorites.

It should, however, be noted that the pair’s south-run below 0.6925 negates medium-term upside while dragging the quote towards a 50% Fibonacci retracement level of 0.6875.

Alternatively, buyers will not take the risk unless prices cross the latest high surrounding 0.7045.

In doing so, July month top around 0.7085 and 0.7100 round-figure will be on their radars.

AUD/USD daily chart

Trend: Pullback expected