When are the Eurozone Preliminary CPIs and how could they affect EUR/USD?

Eurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for November at 1000 GMT today. The headline CPI is anticipated to inch higher to 0.9% YoY while the core inflation is also seen a tad higher at 1.2% YoY during the reported month vs. +1.1% last.

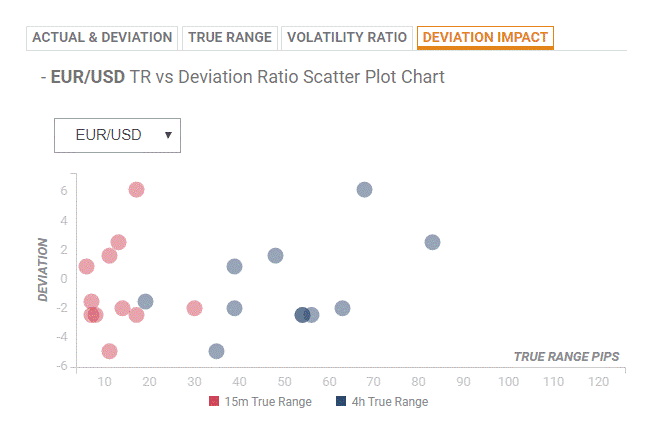

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 30 pips in deviations up to 1.5 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Haresh Menghani, FXStreet's own Analyst, offers important technical levels ahead of the key release: “From a technical perspective, nothing seems to have changed much for the pair and the near-term bias remains tilted in favor of bearish traders. However, it will be prudent to wait for some follow-through selling below monthly lows support, around the 1.0990 region, before positioning for any further depreciating move. The pair then could accelerate the slide further towards testing the 1.0955-50 intermediate support before eventually dropping to the 1.0900 round-figure mark.”

“On the flip side, the weekly swing lows, around the 1.1025-30 region, now seems to have emerged as an immediate strong resistance, above which a bout of short-covering could lift the pair to back towards 100-day SMA near the 1.1080 region”, Haresh adds.

Key Notes

EUR/USD looks for direction near 1.10 ahead of key data

German Retail Sales drop 1.9% MoM in Oct, a big miss - EUR unfazed

Thin conditions, busy calendar, month end flow

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).