Back

9 Oct 2019

GBP/USD technical analysis: Cable trading below 1.2230 ahead of the FOMC Minutes

- GBP/USD is retracing the Brexit-related spike to 1.2292.

- The level to beat for bears is the 1.2200 support.

- The FOMC Minutes are scheduled at 18:00 GMT.

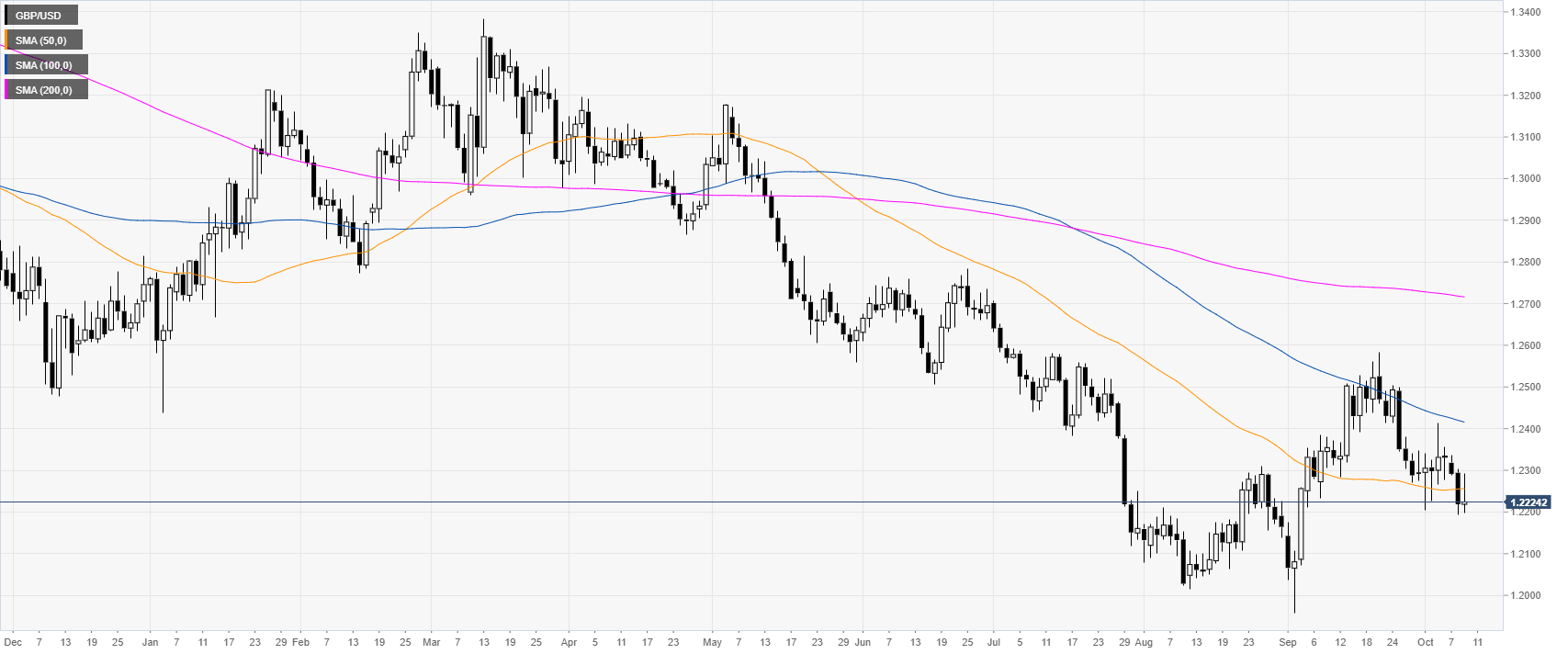

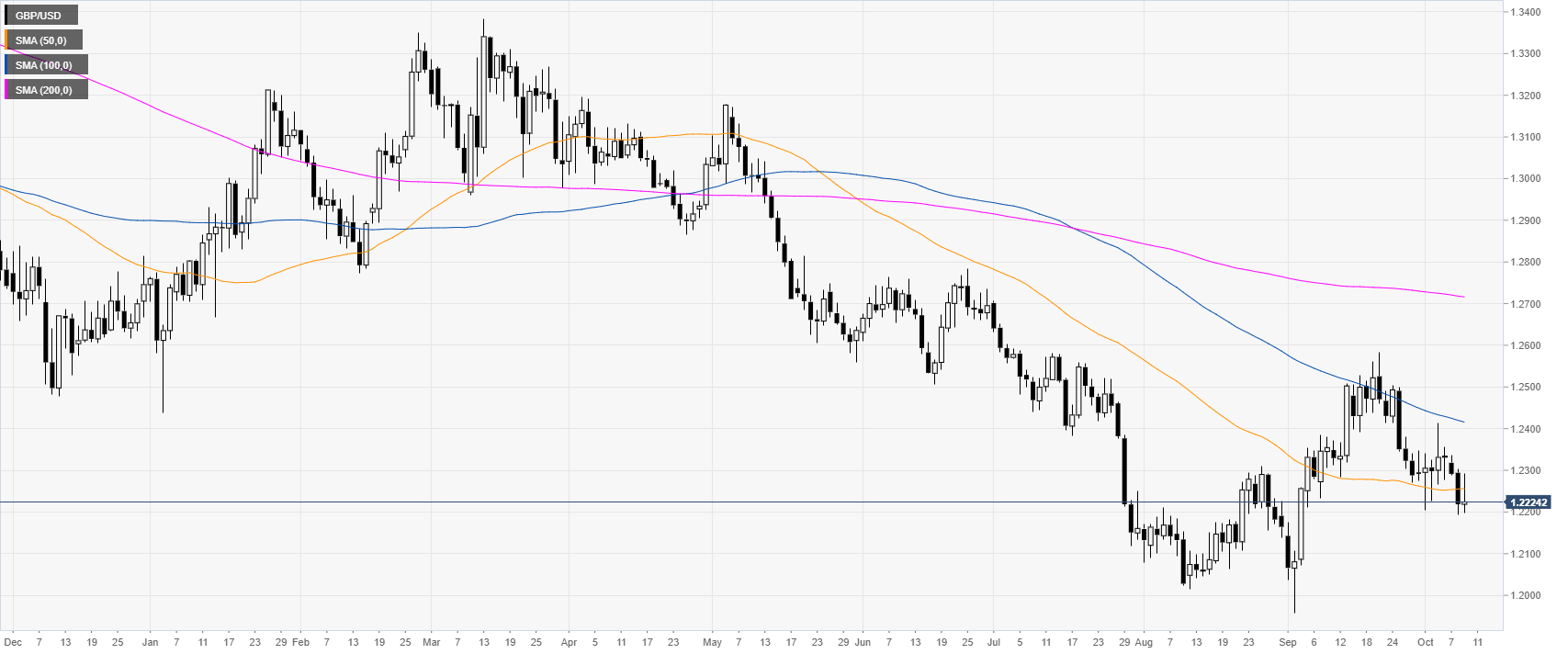

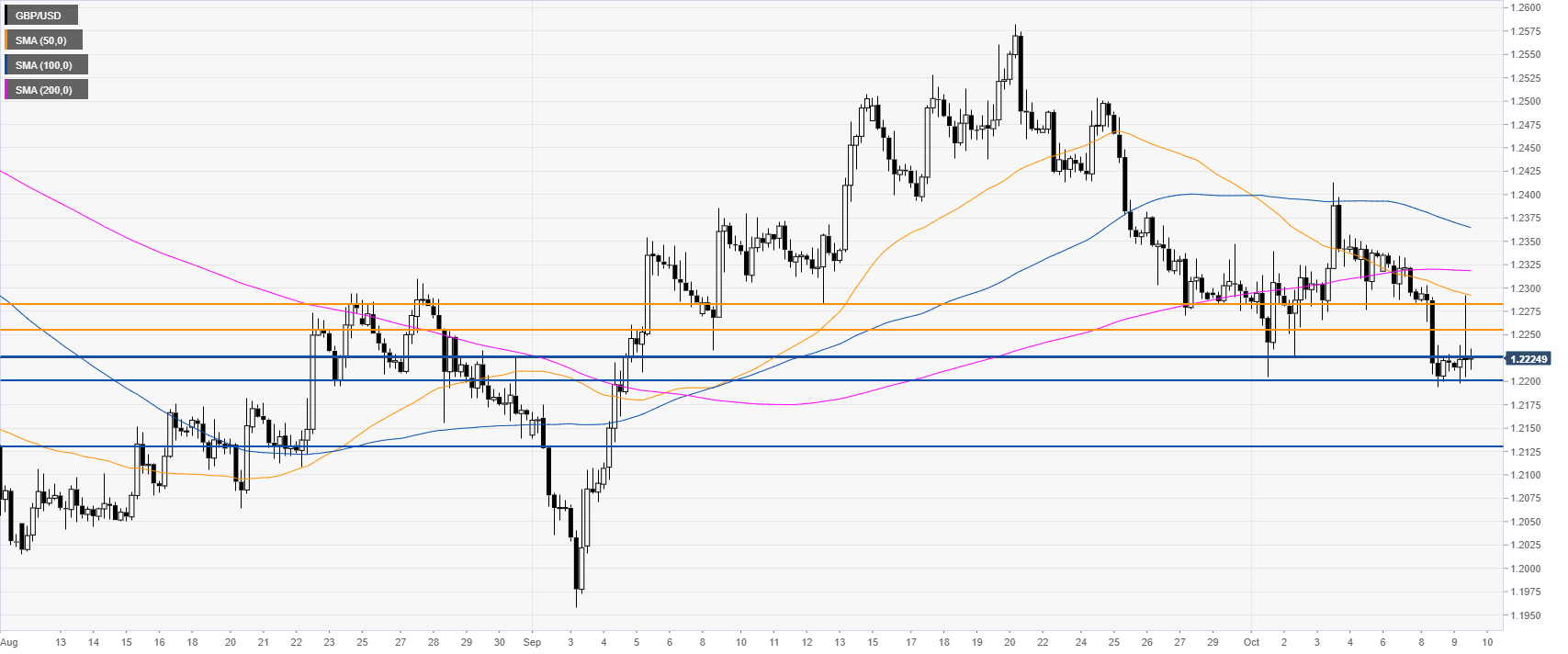

GBP/USD daily chart

On the daily chart, the Cable is trading in a bear trend below the main daily simple moving averages (DSMAs). At the start of the day, GBP/USD jumped on reports of EU concession on the Irish backstop. The FOMC Minutes scheduled at 18:00 GMT can lead to some volatility on the currency pair.

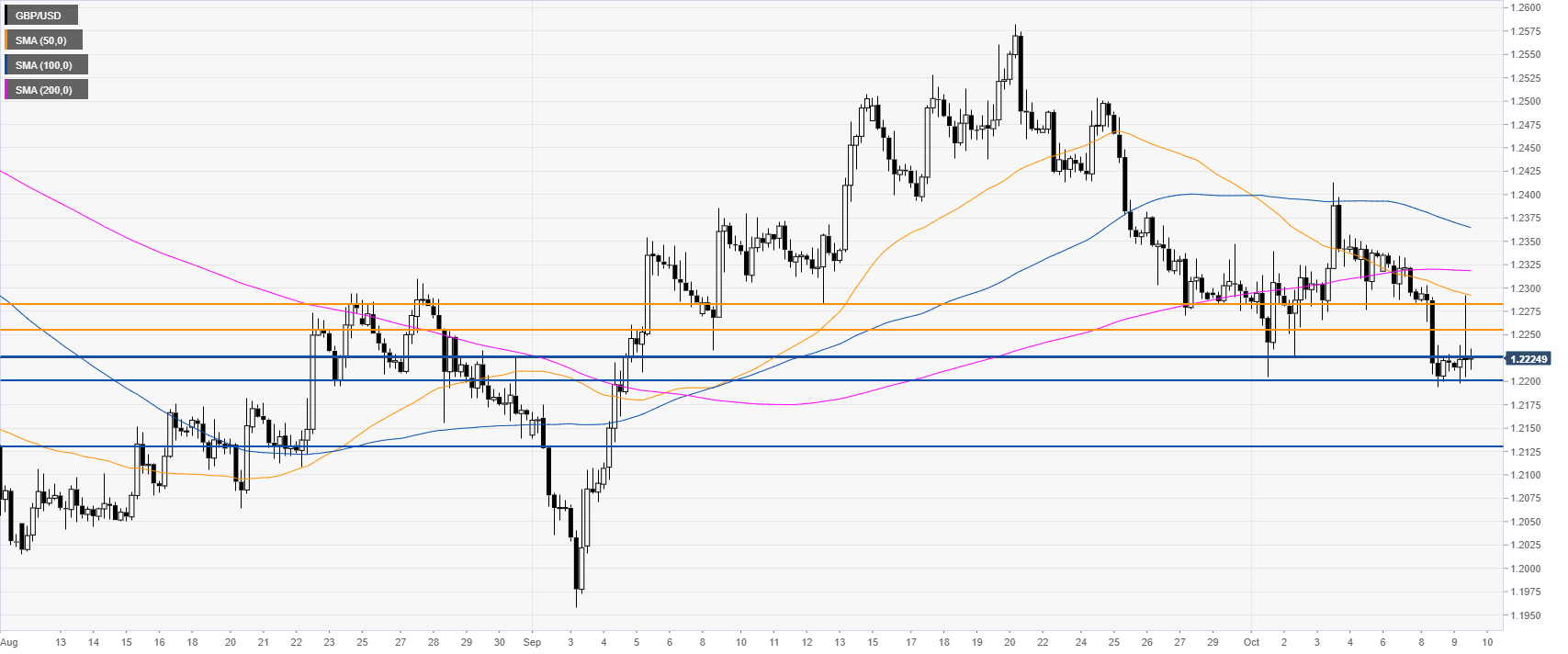

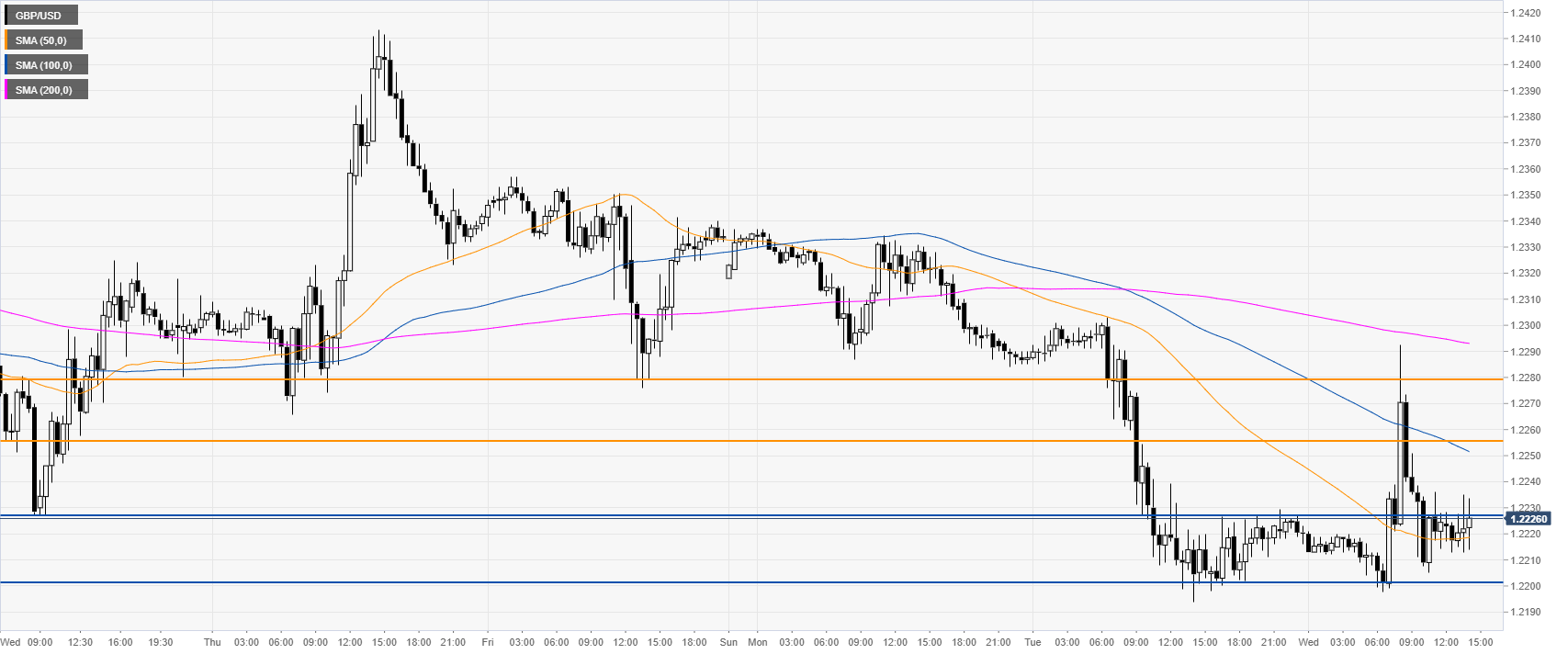

GBP/USD four-hour chart

GBP/USD is back into the 1.2200/1.2226 support zone. A break below 1.2200 can expose the 1.2130 level to the downside, according to the Technical Confluences Indicator.

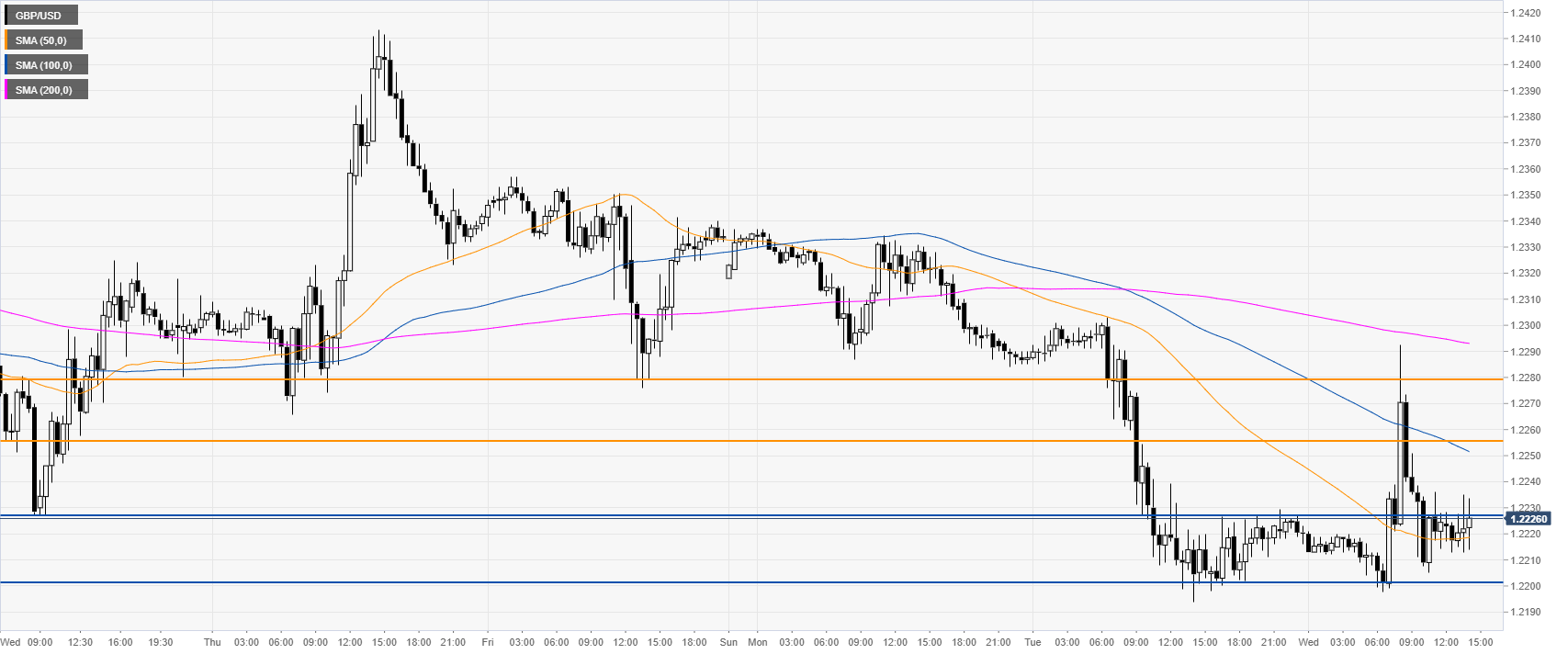

GBP/USD 30-minute chart

The Sterling is trading below the 100 and 200 SMAs, suggesting a bearish bias in the near term. Resistances are seen at the 1.2255 and 1.2280 price levels, according to the Technical Confluences Indicator.

Additional key levels