Back

10 Sep 2018

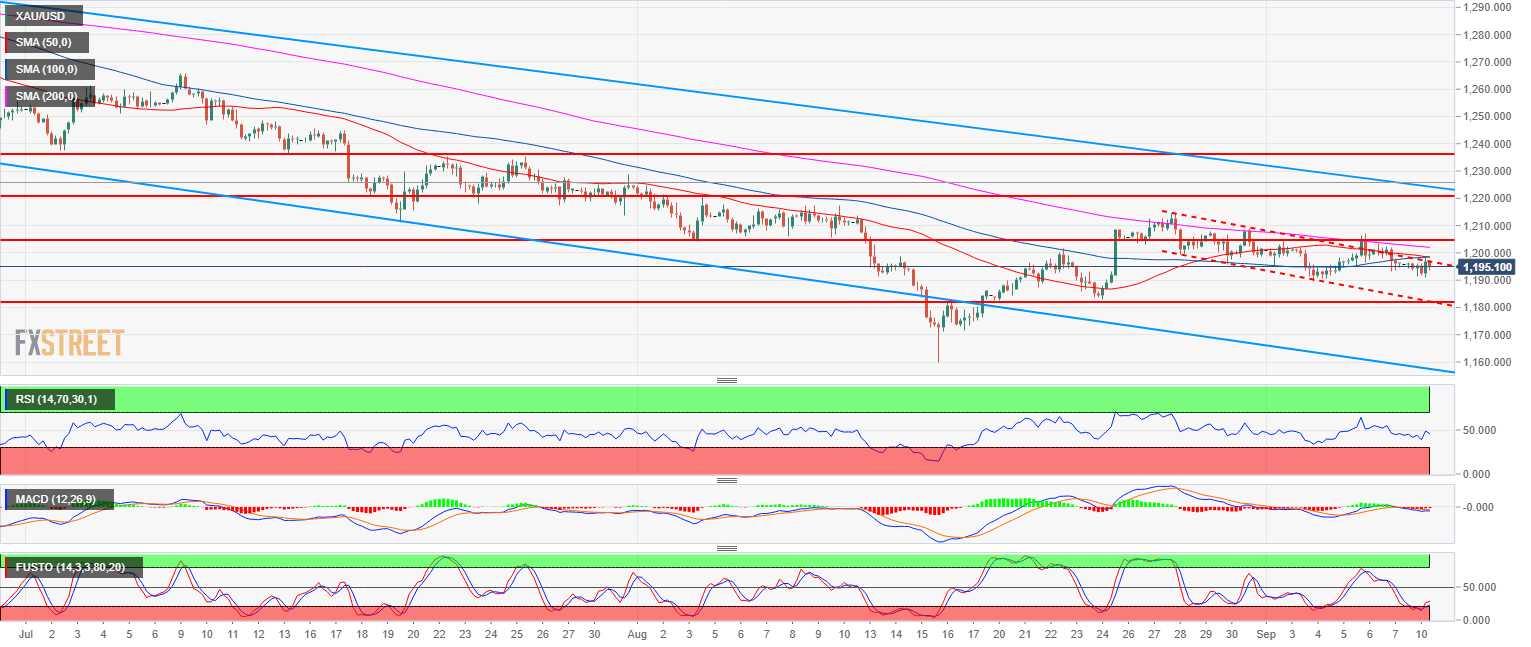

Gold Technical Analysis: Bull flag hanging above $1,190.00 a troy ounce still looking at 1,226.00 target

- Gold bear trend has been losing some bearish steam in the last two weeks as the market found a bottom at $1,172.82 a troy ounce.

- Bulls are attempting to create a bull flag above 1,182.90 August 24 low. The bull confirmation would come on a break above 1,204.10 (August 3 swing low) along with the 50, 100 and 200-period simple moving averages. The bull targets are seen at 1,220.90 (July 18 low) and 1,225.90 (July 17 low)

- Alternatively, a bear breakout below 1,182.90 (August 24 low) would invalidate the bullish scenario and open the gates to a potential retest of the 2018 low.

Gold 4-hour chart

Spot rate: 1,195.40

Relative change: -0.02%

High: 1,198.70

Low: 1,191.14

Trend: Bearish

Short-term trend: Bullish above 1,182.90

Resistance 1: 1,204.10, August 3 swing low (key level)

Resistance 2: 1,211.17 July 19 low

Resistance 3: 1,213.70 July 31 low

Resistance 4: 1,217.89-1,220.90 zone, August 6 high and July 18 low

Resistance 5: 1,225.90 July 17 low

Support 1: 1,194.30 March 10, 2017 low

Support 2: 1,189.49 September 4 low

Support 3: 1,172.82 current 2018 low

Support 4: 1,145.20 March, 1 2017 low