AUD/USD Review: Hangs near 20-month lows, remains vulnerable to slide further

• Disappointing Chinese data dump keeps a lid on any attempted recovery move.

• Weaker copper prices offset a subdued USD demand and do little to lend support.

The AUD/USD pair struggled to register any meaningful recovery and remains within striking distance of 20-month lows, set in the previous session.

The pair's attempted recovery at the start of a new trading week faced rejection near the 0.7300 handle, with today's dismal Chinese data dump further collaborating towards keeping a lid on any meaningful up-move.

Chinese macro data released this Tuesday showed July retail sales growth stood at 8.8% y/y as compared to 9.0% expected and industrial output grew by 6.0% y/y as against 6.3% anticipated.

Adding to the disappointment, China's fixed asset investment in the first seven months of the year slowed to a record low, highlighting faltering business confidence and eventually weighed on the China-proxy Australian Dollar.

However, a modest US Dollar profit-taking, despite a goodish follow-through pickup in the US Treasury bond yields, might help limit deeper losses, albeit the positive effect was largely negated by weaker copper prices, which tend to undermine demand for the commodity-linked Australian Dollar.

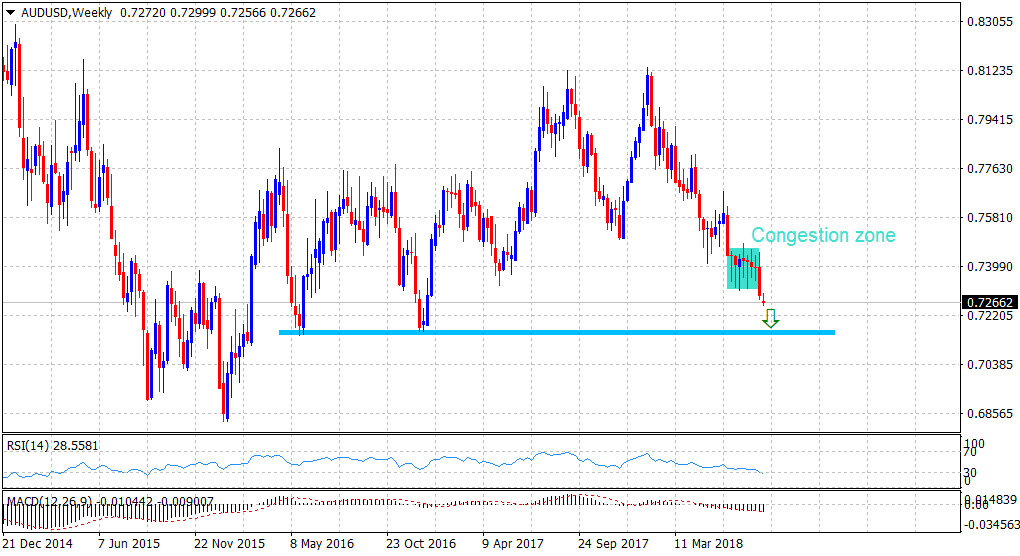

Technical Analysis

From a technical perspective, the pair last week confirmed a bearish breakdown by a consolidative trading range, held over the past eight weeks or so. Moreover, the pair's inability to attract any buying interest, despite near-term oversold conditions, clearly suggests that the near-term selling bias might still far from over.

Hence, the pair remains vulnerable to continue with its downward trajectory and aim towards challenging an important horizontal support near the 0.7160-50 region, with some intermediate support near the 0.7200 round figure mark.