Back

17 Jul 2018

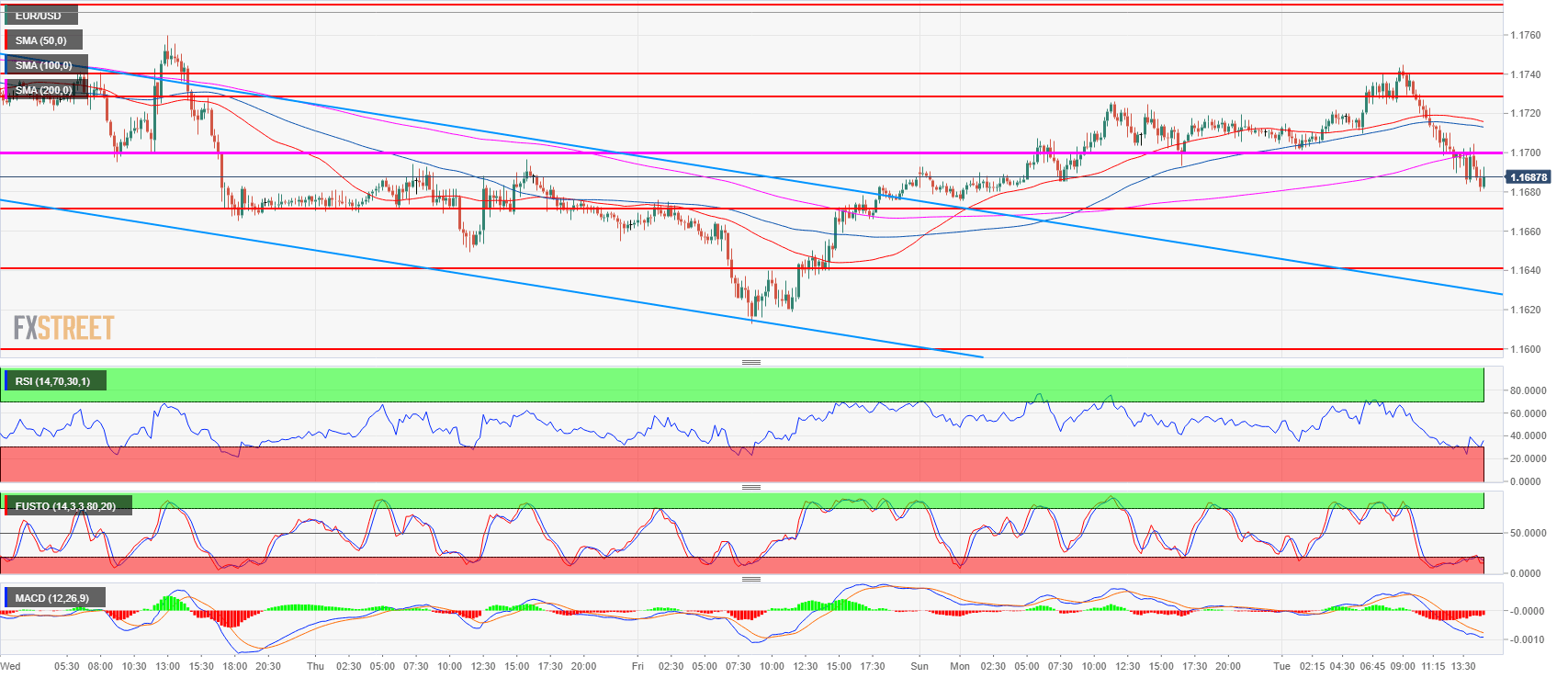

EUR/USD Technical Analysis: EUR/USD grinding lower below 1.1700 figure post-Fed’s Powell speech

- EUR/USD is starting to breakdown below the 1.1700 figure and the 200-period simple moving avearge but without much momentum just yet.

- The 1.1700 level should act as resistance as the bears will try to breakout below 1.1672 to target the 1.1640-1.1649 area, key level and July 12 low.

- Fed’s Powell speech was mainly bullish for USD. Powell Quick Analysis: bullish on jobs, bullish on inflation, dodging trade, more USD gains?

EUR/USD 15-minute chart

Spot rate: 1.1687

Relative change: -0.21%

High: 1.1745

Low: 1.1680

Trend: Bearish

Resistance 1: 1.1700 figure

Resistance 2: 1.1730-1.1740 area, 23.6% Fibonacci retracement from mid-April-May bear move and last week’s open.

Resistance 3: 1.1790 last week’s high

Resistance 4: 1.1851-1.1854 area, June high and 38.2% Fibonacci retracement from mid-April-May bear move

Support 1: 1.1672 June 27 high

Support 2: 1.1640-1.1649 area, key level and July 12 low

Support 3: 1.1613 current weekly low

Support 4: 1.1600 figure

Support 5: 1.1560 June 14 low

Support 6: 1.1508 current 2018 low