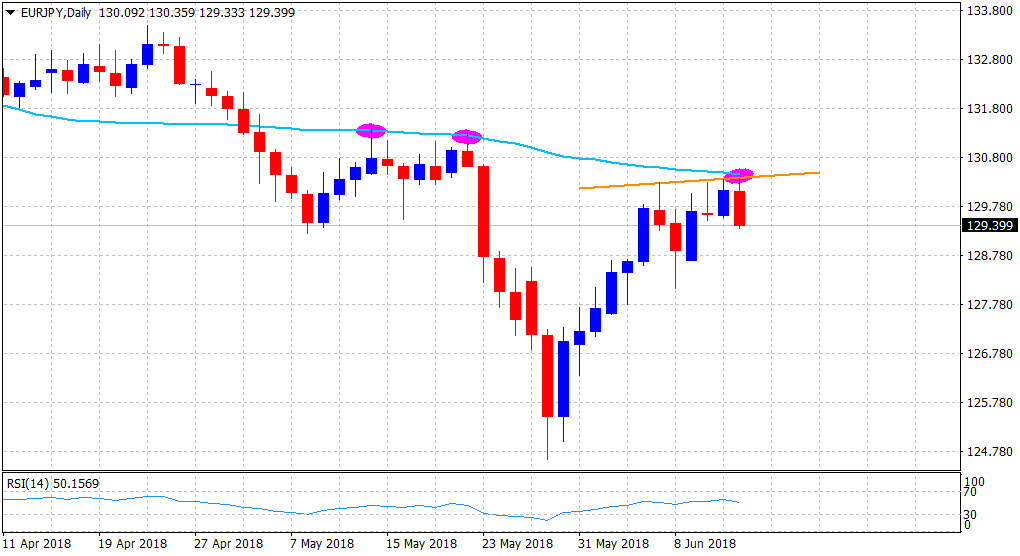

EUR/JPY Technical Analysis: rejected near 50-day SMA post-ECB

• Retreats sharply from 50-day SMA after ECB said that the key interest rates are expected to remain at their present levels at least through the summer of 2019.

• Repeated failures ahead of a short-term moving average, for the third time in the past one-month, clearly suggests that the near-term downslide might still be far from over.

• A follow-through selling would reaffirm the negative outlook and pave the way for an extension of the downslide back towards the 127.00 round figure mark.

• Only a decisive breakthrough mid-130.00s (50-DMA) would negate the bearish bias and pave the way for a fresh leg of up-move.

EUR/JPY daily chart

Spot Rate: 129.40

Daily High: 130.36

Trend: Bearish

Resistance

R1: 129.62 (horizontal level)

R2: 130.00 (psychological round figure mark)

R3: 130.44 (50-day SMA)

Support

S1: 129.00 (round figure mark)

S2: 128.66 (weekly low)

S3: 128.11 (last Friday's swing low)