EUR/USD back into tiny ranges post FOMC

- EUR/USD bulls were unable to break the 1.2400 level.

- EUR/USD will most likely need a strong catalyst to break above 1.2500.

The EUR/USD is trading at around 1.2310, down 0.20% on the day as market participants digest the news from the FOMC meeting which took place on Wednesday.

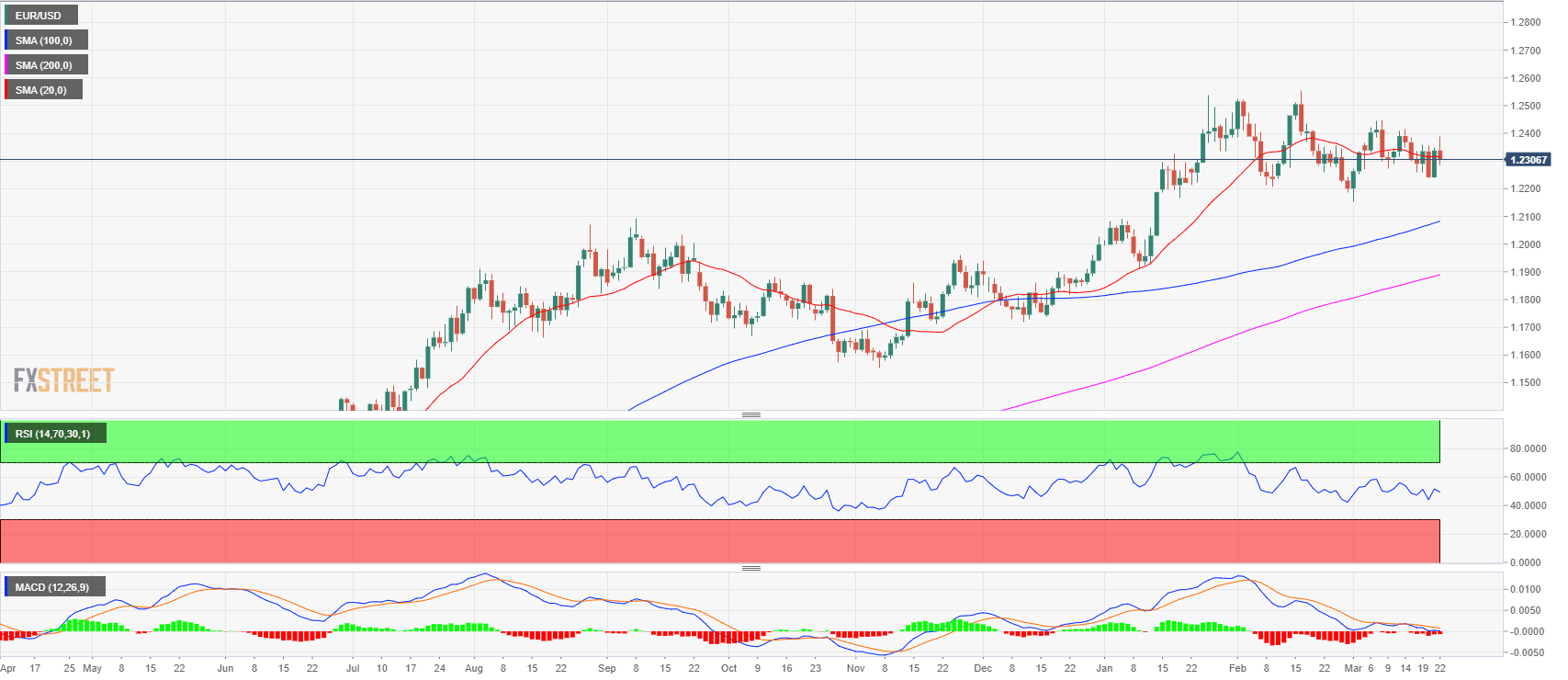

EUR/USD daily chart:

The FOMC meeting didn’t provide a clear direction for the EUR/USD. While bulls took the upper hand on Wednesday after the FOMC meeting, they couldn't break the 1.2400 resistance. The single currency is trading above both its 100 and 200-period simple moving average so the trend is still basically in place. However, the consolidation has been taking place since mid-January of this year with the market now trading between the 1.2200-1.2400 range. The market will likely need a strong reason to make a clear break above the 1.2500 multi-year pivot level. For example, the ECB might have to over-deliver or the Fed disappoint greatly, or some political conjunction would have to enter into play, but it is likely that some catalysts will be strong enough to break 1.2500. Neither the RSI nor the MACD indicate that a bull continuation is underway as of now.

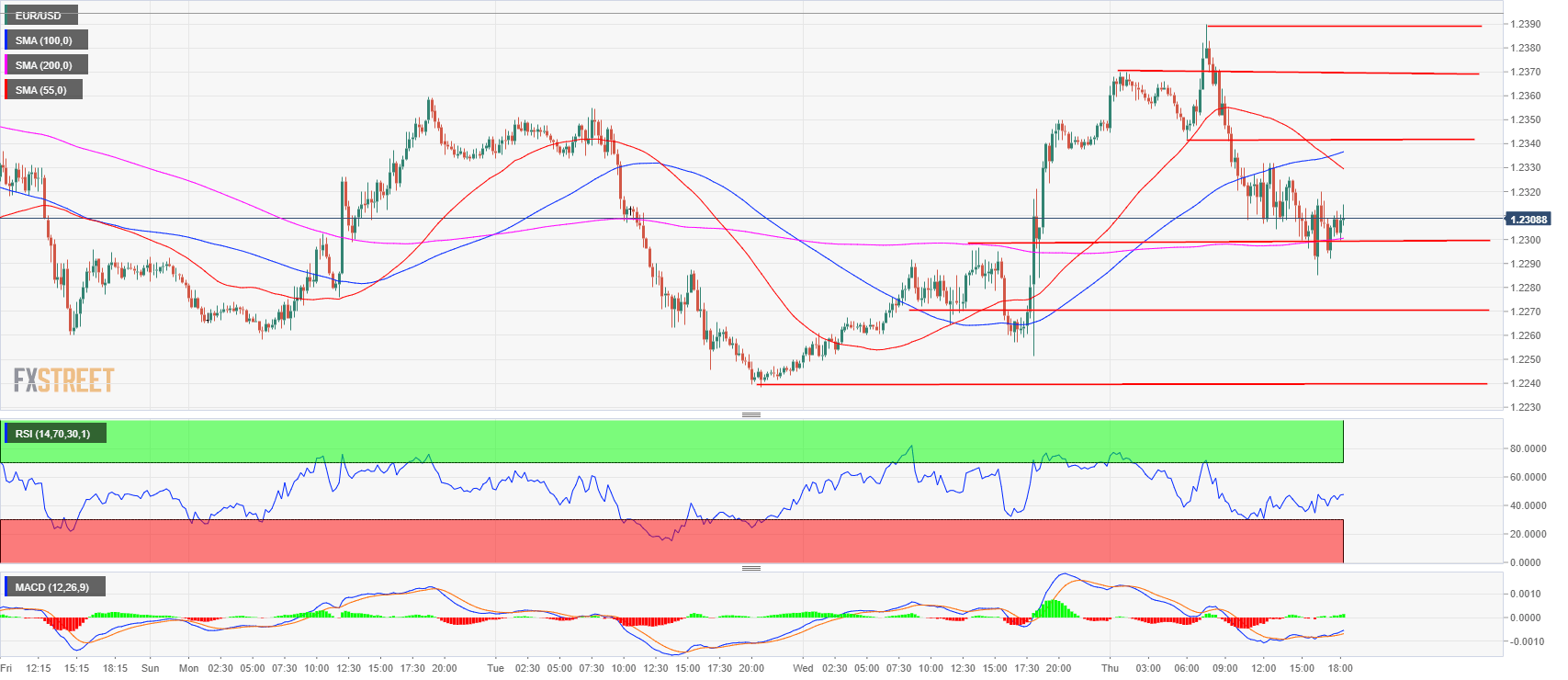

EUR/USD 15-minute chart:

The EUR/USD found some support at the 1.2300 figure, helped by the 200 SMA. Both the RSI and the MACD are showing some positive divergences. Traders are likely expecting a little bounce here with the possibility to reach 1.2340 previous supply zone. Further resistance is seen at 1.2370 Asia high and finally at 1.2390 which is the high of the day. On the flip side, if the bulls fail, support is seen at 1.2270 previous bull base and at 1.2240 Wednesday´s low.