Back

11 Oct 2022

Crude Oil Futures: Extra decline looks contained

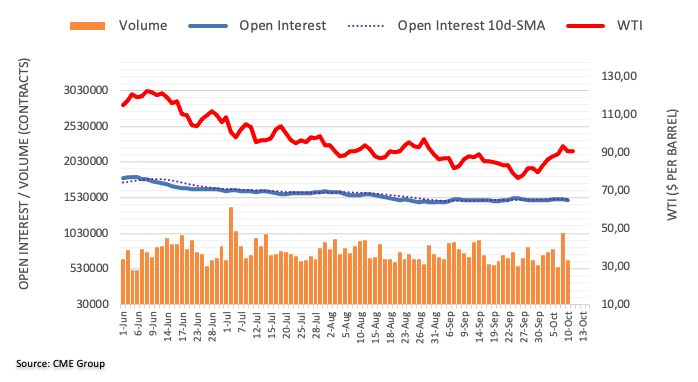

According to preliminary readings from CME Group for crude oil futures markets, traders trimmed their open interest positions by around 14.1K contracts at the beginning of the week, reaching the second consecutive daily drop. Volume followed suit and shrank by around 385.5K contracts, partially reversing the previous daily build.

WTI keeps targeting the 200-day SMA

Prices of the WTI started the week on the defensive and gave away some gains after surpassing the $93.00 mark per barrel on Monday. The move was on the back of shrinking open interest and volume and leaves the possibility of further downside curtailed in the very near term. On the upside, the next hurdle emerges at the 200-day SMA just above the $98.00 mark per barrel.